Page 19 - BudgetBookCover_FY26_Adopted.pdf

P. 19

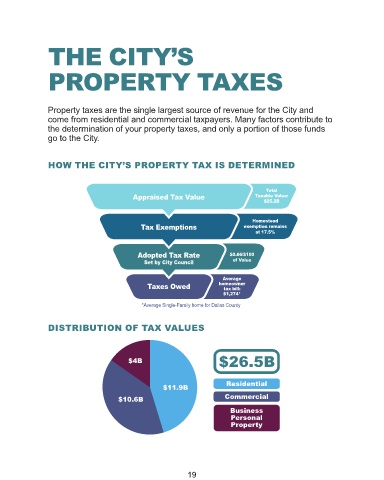

THE CITY’S

PROPERTY TAXES

Property taxes are the single largest source of revenue for the City and

come from residential and commercial taxpayers. Many factors contribute to

the determination of your property taxes, and only a portion of those funds

go to the City.

HOW THE CITY’S PROPERTY TAX IS DETERMINED

Total

Appraised Tax Value Taxable Value:

$25.2B

Homestead

Tax Exemptions exemption remains

at 17.5%

Adopted Tax Rate $0.66/$100

Set by City Council of Value

Average

Taxes Owed homeowner

tax bill:

$1,274*

*Average Single-Family home for Dallas County

DISTRIBUTION OF TAX VALUES

$26.5B

$4B

Residential

$11.9B

$10.6B Commercial

Business

Personal

Property

19