Page 123 - CityofWataugaAdoptedBudgetFY25

P. 123

BUDGET SUMMARY

REVENUE

DESCRIPTIONS, EVALUATIONS, AND PROJECTIONS

TAXES

The revenues from taxes are classified as general property taxes, sales taxes (consumer

taxes), and franchise taxes in the General Fund Operating Budget. These taxes are

levied to provide for general municipal services and benefits to the citizens. Sales taxes

are also distributed to the Economic Development Corporation and Crime Control District,

which are special revenue funds.

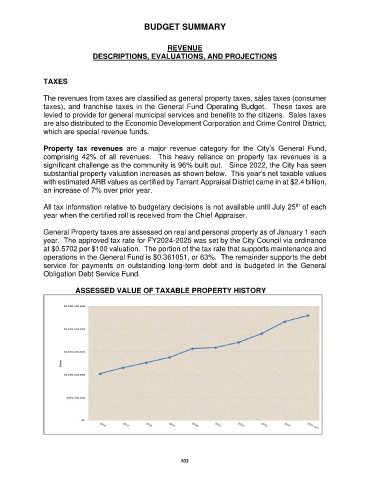

Property tax revenues are a major revenue category for the City’s General Fund,

comprising 42% of all revenues. This heavy reliance on property tax revenues is a

significant challenge as the community is 96% built out. Since 2022, the City has seen

substantial property valuation increases as shown below. This year’s net taxable values

with estimated ARB values as certified by Tarrant Appraisal District came in at $2.4 billion,

an increase of 7% over prior year.

th

All tax information relative to budgetary decisions is not available until July 25 of each

year when the certified roll is received from the Chief Appraiser.

General Property taxes are assessed on real and personal property as of January 1 each

year. The approved tax rate for FY2024-2025 was set by the City Council via ordinance

at $0.5702 per $100 valuation. The portion of the tax rate that supports maintenance and

operations in the General Fund is $0.361051, or 63%. The remainder supports the debt

service for payments on outstanding long-term debt and is budgeted in the General

Obligation Debt Service Fund.

ASSESSED VALUE OF TAXABLE PROPERTY HISTORY

103