Page 50 - City of Fort Worth Budget Book

P. 50

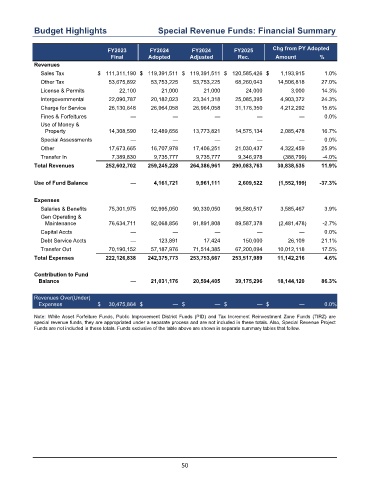

Budget Highlights Special Revenue Funds: Financial Summary

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Sales Tax $ 111,311,190 $ 119,391,511 $ 119,391,511 $ 120,585,426 $ 1,193,915 1.0 %

Other Tax 53,675,892 53,753,225 53,753,225 68,260,043 14,506,818 27.0 %

License & Permits 22,100 21,000 21,000 24,000 3,000 14.3 %

Intergovernmental 22,090,787 20,182,023 23,341,318 25,085,395 4,903,372 24.3 %

Charge for Service 26,130,648 26,964,058 26,964,058 31,176,350 4,212,292 15.6 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money &

Property 14,308,590 12,489,656 13,773,821 14,575,134 2,085,478 16.7 %

Special Assessments — — — — — 0.0 %

Other 17,673,665 16,707,978 17,406,251 21,030,437 4,322,459 25.9 %

Transfer In 7,389,830 9,735,777 9,735,777 9,346,978 (388,799) -4.0 %

Total Revenues 252,602,702 259,245,228 264,386,961 290,083,763 30,838,535 11.9 %

Use of Fund Balance — 4,161,721 9,961,111 2,609,522 (1,552,199) -37.3 %

Expenses

Salaries & Benefits 75,301,975 92,995,050 90,330,050 96,580,517 3,585,467 3.9 %

Gen Operating &

Maintenance 76,634,711 92,068,856 91,891,808 89,587,378 (2,481,478) -2.7 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — 123,891 17,424 150,000 26,109 21.1 %

Transfer Out 70,190,152 57,187,976 71,514,385 67,200,094 10,012,118 17.5 %

Total Expenses 222,126,838 242,375,773 253,753,667 253,517,989 11,142,216 4.6 %

Contribution to Fund

Balance — 21,031,176 20,594,405 39,175,296 18,144,120 86.3 %

Revenues Over(Under)

Expenses $ 30,475,864 $ — $ — $ — $ — 0.0 %

Note: While Asset Forfeiture Funds, Public Improvement District Funds (PID) and Tax Increment Reinvestment Zone Funds (TIRZ) are

special revenue funds, they are appropriated under a separate process and are not included in these totals. Also, Special Revenue Project

Funds are not included in these totals. Funds exclusive of the table above are shown in separate summary tables that follow.

50