Page 49 - City of Fort Worth Budget Book

P. 49

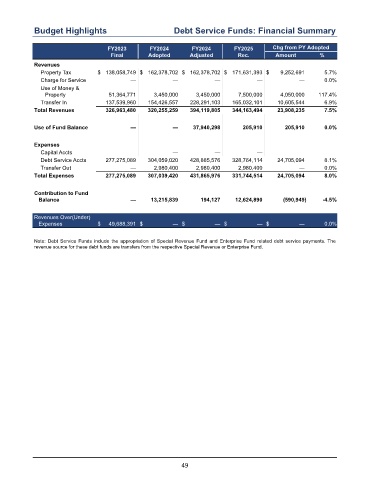

Budget Highlights Debt Service Funds: Financial Summary

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ 138,058,749 $ 162,378,702 $ 162,378,702 $ 171,631,393 $ 9,252,691 5.7 %

Charge for Service — — — — — 0.0 %

Use of Money &

Property 51,364,771 3,450,000 3,450,000 7,500,000 4,050,000 117.4 %

Transfer In 137,539,960 154,426,557 228,291,103 165,032,101 10,605,544 6.9 %

Total Revenues 326,963,480 320,255,259 394,119,805 344,163,494 23,908,235 7.5 %

Use of Fund Balance — — 37,940,298 205,910 205,910 0.0 %

Expenses

Capital Accts — — —

Debt Service Accts 277,275,089 304,059,020 428,885,576 328,764,114 24,705,094 8.1 %

Transfer Out — 2,980,400 2,980,400 2,980,400 — 0.0 %

Total Expenses 277,275,089 307,039,420 431,865,976 331,744,514 24,705,094 8.0 %

Contribution to Fund

Balance — 13,215,839 194,127 12,624,890 (590,949) -4.5 %

Revenues Over(Under)

Expenses $ 49,688,391 $ — $ — $ — $ — 0.0 %

Note: Debt Service Funds include the appropriation of Special Revenue Fund and Enterprise Fund related debt service payments. The

revenue source for these debt funds are transfers from the respective Special Revenue or Enterprise Fund.

49