Page 45 - City of Fort Worth Budget Book

P. 45

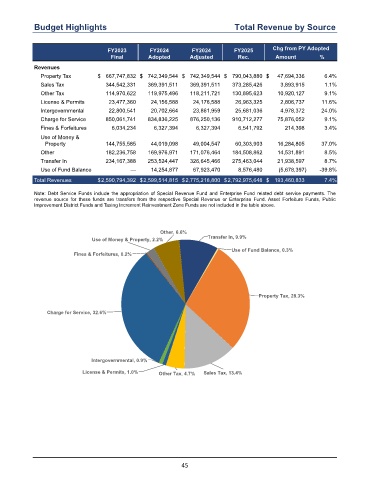

Budget Highlights Total Revenue by Source

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ 667,747,832 $ 742,349,544 $ 742,349,544 $ 790,043,880 $ 47,694,336 6.4 %

Sales Tax 344,542,331 369,391,511 369,391,511 373,285,426 3,893,915 1.1 %

Other Tax 114,970,622 119,975,496 118,211,721 130,895,623 10,920,127 9.1 %

License & Permits 23,477,360 24,156,588 24,176,588 26,963,325 2,806,737 11.6 %

Intergovernmental 22,800,541 20,702,664 23,861,959 25,681,036 4,978,372 24.0 %

Charge for Service 850,061,741 834,836,225 876,250,136 910,712,277 75,876,052 9.1 %

Fines & Forfeitures 6,034,234 6,327,394 6,327,394 6,541,792 214,398 3.4 %

Use of Money &

Property 144,755,585 44,019,098 49,004,547 60,303,903 16,284,805 37.0 %

Other 182,236,758 169,976,971 171,076,464 184,508,862 14,531,891 8.5 %

Transfer In 234,167,388 253,524,447 326,645,466 275,463,044 21,938,597 8.7 %

Use of Fund Balance — 14,254,877 67,923,470 8,576,480 (5,678,397) -39.8 %

Total Revenues $ 2,590,794,392 $ 2,599,514,815 $ 2,775,218,800 $ 2,792,975,648 $ 193,460,833 7.4 %

Note: Debt Service Funds include the appropriation of Special Revenue Fund and Enterprise Fund related debt service payments. The

revenue source for these funds are transfers from the respective Special Revenue or Enterprise Fund. Asset Forfeiture Funds, Public

Improvement District Funds and Taxing Increment Reinvestment Zone Funds are not included in the table above.

Other, 6.6%

Transfer In, 9.9%

Use of Money & Property, 2.2%

Use of Fund Balance, 0.3%

Fines & Forfeitures, 0.2%

Property Tax, 28.3%

Charge for Service, 32.6%

Intergovernmental, 0.9%

License & Permits, 1.0% Other Tax, 4.7% Sales Tax, 13.4%

45