Page 43 - City of Fort Worth Budget Book

P. 43

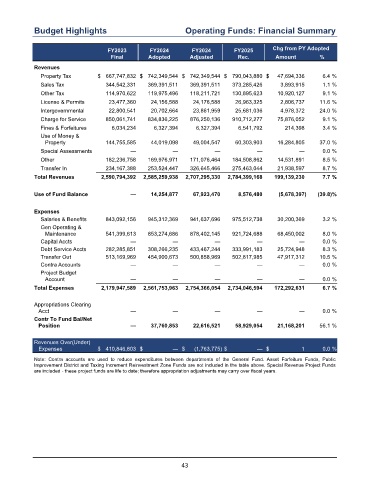

Budget Highlights Operating Funds: Financial Summary

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ 667,747,832 $ 742,349,544 $ 742,349,544 $ 790,043,880 $ 47,694,336 6.4 %

Sales Tax 344,542,331 369,391,511 369,391,511 373,285,426 3,893,915 1.1 %

Other Tax 114,970,622 119,975,496 118,211,721 130,895,623 10,920,127 9.1 %

License & Permits 23,477,360 24,156,588 24,176,588 26,963,325 2,806,737 11.6 %

Intergovernmental 22,800,541 20,702,664 23,861,959 25,681,036 4,978,372 24.0 %

Charge for Service 850,061,741 834,836,225 876,250,136 910,712,277 75,876,052 9.1 %

Fines & Forfeitures 6,034,234 6,327,394 6,327,394 6,541,792 214,398 3.4 %

Use of Money &

Property 144,755,585 44,019,098 49,004,547 60,303,903 16,284,805 37.0 %

Special Assessments — — — — — 0.0 %

Other 182,236,758 169,976,971 171,076,464 184,508,862 14,531,891 8.5 %

Transfer In 234,167,388 253,524,447 326,645,466 275,463,044 21,938,597 8.7 %

Total Revenues 2,590,794,392 2,585,259,938 2,707,295,330 2,784,399,168 199,139,230 7.7 %

Use of Fund Balance — 14,254,877 67,923,470 8,576,480 (5,678,397) (39.8) %

Expenses

Salaries & Benefits 843,092,156 945,312,369 941,637,696 975,512,738 30,200,369 3.2 %

Gen Operating &

Maintenance 541,399,613 853,274,686 878,402,145 921,724,688 68,450,002 8.0 %

Capital Accts — — — — — 0.0 %

Debt Service Accts 282,285,851 308,266,235 433,467,244 333,991,183 25,724,948 8.3 %

Transfer Out 513,169,969 454,900,673 500,858,969 502,817,985 47,917,312 10.5 %

Contra Accounts — — — — — 0.0 %

Project Budget

Account — — — — — 0.0 %

Total Expenses 2,179,947,589 2,561,753,963 2,754,366,054 2,734,046,594 172,292,631 6.7 %

Appropriations Clearing

Acct — — — — — 0.0 %

Contr To Fund Bal/Net

Position — 37,760,853 22,616,521 58,929,054 21,168,201 56.1 %

Revenues Over(Under)

Expenses $ 410,846,803 $ — $ (1,763,775) $ — $ 1 0.0 %

Note: Contra accounts are used to reduce expenditures between departments of the General Fund. Asset Forfeiture Funds, Public

Improvement District and Taxing Increment Reinvestment Zone Funds are not included in the table above. Special Revenue Project Funds

are included - these project funds are life to date; therefore appropriation adjustments may carry over fiscal years.

43