Page 51 - City of Fort Worth Budget Book

P. 51

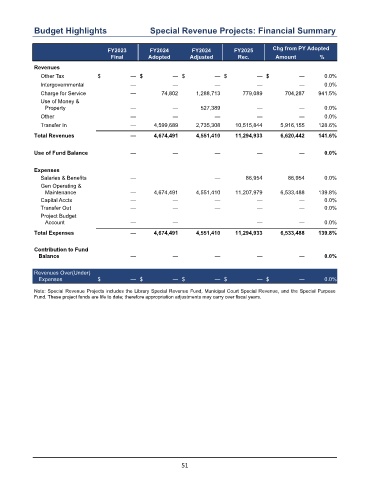

Budget Highlights Special Revenue Projects: Financial Summary

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Other Tax $ — $ — $ — $ — $ — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service — 74,802 1,288,713 779,089 704,287 941.5 %

Use of Money &

Property — — 527,389 — — 0.0 %

Other — — — — — 0.0 %

Transfer In — 4,599,689 2,735,308 10,515,844 5,916,155 128.6 %

Total Revenues — 4,674,491 4,551,410 11,294,933 6,620,442 141.6 %

Use of Fund Balance — — — — — 0.0 %

Expenses

Salaries & Benefits — — 86,954 86,954 0.0 %

Gen Operating &

Maintenance — 4,674,491 4,551,410 11,207,979 6,533,488 139.8 %

Capital Accts — — — — — 0.0 %

Transfer Out — — — — — 0.0 %

Project Budget

Account — — — — 0.0 %

Total Expenses — 4,674,491 4,551,410 11,294,933 6,533,488 139.8 %

Contribution to Fund

Balance — — — — — 0.0 %

Revenues Over(Under)

Expenses $ — $ — $ — $ — $ — 0.0 %

Note: Special Revenue Projects includes the Library Special Revenue Fund, Municipal Court Special Revenue, and the Special Purpose

Fund. These project funds are life to date; therefore appropriation adjustments may carry over fiscal years.

51