Page 271 - City of Fort Worth Budget Book

P. 271

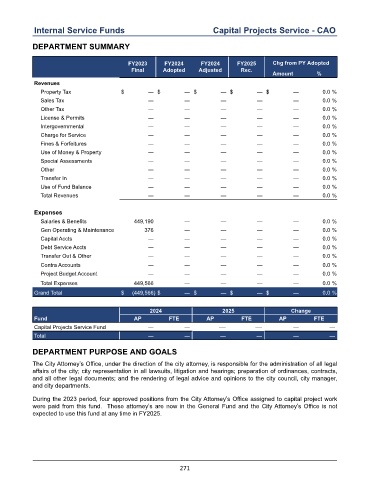

Internal Service Funds Capital Projects Service - CAO

DEPARTMENT SUMMARY

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec.

Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax — — — — — 0.0 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service — — — — — 0.0 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property — — — — — 0.0 %

Special Assessments — — — — — 0.0 %

Other — — — — — 0.0 %

Transfer In — — — — — 0.0 %

Use of Fund Balance — — — — — 0.0 %

Total Revenues — — — — — 0.0 %

Expenses

Salaries & Benefits 449,190 — — — — 0.0 %

Gen Operating & Maintenance 376 — — — — 0.0 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — — — — — 0.0 %

Transfer Out & Other — — — — — 0.0 %

Contra Accounts — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses 449,566 — — — — 0.0 %

Grand Total $ (449,566) $ — $ — $ — $ — 0.0 %

2024 2025 Change

Fund AP FTE AP FTE AP FTE

Capital Projects Service Fund — — — — — —

Total — — — — — —

DEPARTMENT PURPOSE AND GOALS

The City Attorney’s Office, under the direction of the city attorney, is responsible for the administration of all legal

affairs of the city; city representation in all lawsuits, litigation and hearings; preparation of ordinances, contracts,

and all other legal documents; and the rendering of legal advice and opinions to the city council, city manager,

and city departments.

During the 2023 period, four approved positions from the City Attorney’s Office assigned to capital project work

were paid from this fund. These attorney’s are now in the General Fund and the City Attorney’s Office is not

expected to use this fund at any time in FY2025.

271