Page 480 - FY 2025 Adopted Operating Budget and Business Plan

P. 480

Return to Table of Contents

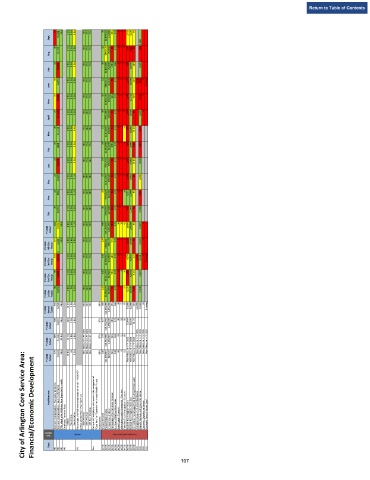

57 45% 1.2% 0.2% 0.6% 74% 27% 27% 48 110,800 66% 173 0 0 0 2,433 4,210 7%

Sept. $2,368 $4,079,313

36 $1,725 0.7% 0.2% 0.0% 74% 27% 27% 42 132,512 0% 172 0 0 0 375 1,688 3% 335 5, 000

Aug. $959,115

44 0.9% 0.2% 0.3% 75% 27% 27% 49 152,160 170% 166 0 0 0 520 10,750 10% 8,000

July $6,109 $2,825,586

50 $4,552 0.9% 0.2% 0.0% 73% 27% 27% 51 142,131 0% 172 1 0 0 1,275 10,750 11% 9,216 3100 0 D rating

June $687,642

47 $4,880 0.9% 0.2% 0.0% 73% 27% 27% 43 133,532 94% 172 1 0 1 1,349 11,748 14% 2,315 0

May $1,025,435

37 $11,339 0.4% 0.0% 0.0% 74% 28% 27% 49 138,300 1% 173 3 4 0 1,954 8,019 9% 6,905 0

April $791,285

30 0.8% 0.2% 0.4% 77% 28% 28% 57 130,883 0% 172 0 1 11 397 10,302 10.3% 2,820

Mar. $11,429 $1,019,155

33 $898 0.5% 0.0% 0.3% 76% 27% 27% 34 111,199 100% 173 1 4 4 559 4,660 6.6% 1,087

Feb. $1,430,596

32 $3,158 0.4% 0.0% 0.3% 76% 27% 26% 54 105,840 0% 172 3 4 0 1,013 19,381 10.8% 8,920

Jan. $761,541

24 $2,829 0.5% 0.0% 0.1% 78% 19% 18% 47 103,320 0% 172 1 0 0 1,209 2,562 6% 4,280

Dec. $1,012,361

44 $694 0.6% 0.0% 0.1% 75% 18% 18% 26 112,768 0% 171 3 3 13 6,551 12,309 9% 2,955

Nov. $754,623

30 $3,762 0.7% 0.0% 0.0% 76% 18% 18% 40 127,606 22% 171 3 2 4 455 11,659 7% 10,280

Oct. $783,391

464 $4,350 45% 8.6% 1.3% 2.1% 75% 25% 25% 540 1,501,051 39% 173 16 18 42 18090 108,038 9% 52,897 0

FY 2024 Actual $16,130,043

137 3,401 45% 2.8% 0.6% 0.9% 74% 27% 27% 139 395,472 57% 173 0 0 0 3,328 16,648 7% 13,335 0

FY 2024 4th Qtr. Actual $ 7,864,014 $

134 $6,541 2.3% 0.5% 0.0% 73% 27% 27% 143 413,963 48% 172 5 4 1 4,578 30,517 11% 9,216 9,220 0 D rating

FY 2024 3rd Qtr. Actual $2,504,362

95 1.7% 0.2% 1.0% 76% 27% 27% 145 347,922 50% 172 4 9 15 1,969 34,343 9.2% 12,827

FY 2024 2nd Qtr. Actual $4,890 $3,211,292

98 $2,156 1.8% 0% 0.2% 76% 18% 18% 113 343,694 7% 172 7 5 17 8,215 26,530 7.7% 17,515

FY 2024 1st Qtr. Actual $2,550,375

550 $3,500 48% 14.5% 2.5% 3.0% 65% 15% 15% 90% 360 25% 166 30 25 65 30,000 42,000 12% 100,000 50,000 25 B rating

FY 2024 Annual Target $14,000,000 1,050,000

508 $4,017 46% 14% 1.2% 2.6% 87% 427 40% 171 30 28 90 25,404 66,370 10.1%

FY 2023 Actual $18,754,356 1,396,019

809 $1,482 45.8% 15.7% 2.8% 2.6% 87% 378 33% 161 31 21 60

FY 2022 Actual New Measure in FY 2024 New Measure in FY 2024 New Measure in FY 2024 $13,387,096 1,060,567 New Measure in FY 2024 New Measure in FY 2024 New Measure in FY 2024 New Measure in FY 2024

576 $3,239 46% 13.8% 1% 3.5% 86% 316 $41,658,867 648,347 34% 149 26 8 32 New Measure in FY 2023 New Measure in FY 2023 New Measure in FY 2023

City of Arlington Core Service Area:

FY 2021

Actual

Financial/Economic Development Key Measures Category Workers' Compensation ‐ Frequency (# claims) Workers' Compensation ‐ Severity ($/claims) FTEs eligible for Wellness Rate [reported annually] Employee Turnover Rate: Civilian Sworn Fire Sworn Police Percentage of all full‐time employees enrolled in 401k/457 pretax and 457 Roth Post Tax Plans 401K Pre‐Tax 457b Pre‐Tax 457 Roth Post‐Tax Percent of Firefighters who score in the categories of “Excellent” or “Supe

Benefits

Convention and Tourism Sales

Goal

Dept.

ACVB

ACVB

ACVB

ACVB

ACVB

ACVB

ACVB

ACVB

ACVB

ACVB

ACVB

Fire

CES

CES

CES

CES

HR

HR

HR

HR

HR

107