Page 216 - CityofWataugaAdoptedBudgetFY24

P. 216

SPECIAL REVENUE FUNDS

CRIME CONTROL DISTRICT – FUND 18

The Crime Control and Prevention District was established to account for a one-half cent sales tax increase

approved by voters on March 23, 1996, for an initial five years and extended by voters each ten years. On the

most recent election, May 1, 2021, voters extended the sales tax collection for ten more years. The purpose of

the increase in sales tax is to enhance law enforcement in Watauga. The additional funding is used to add

officers and purchase additional equipment and supplies for law enforcement purposes.

This is a Special Revenue Fund and is used to account for specific revenues that are legally restricted to

expenditures for particular purposes. The fund is accounted for on the modified accrual basis of accounting.

Revenues are recorded when available and measurable, and expenditures are recorded when the liability is

incurred.

Sales tax revenue for FY2023-2024 is forecasted to be $1,977,000. Sales Tax revenues are projected to be

approximately 2% higher than the FY2022-2023 projected estimate.

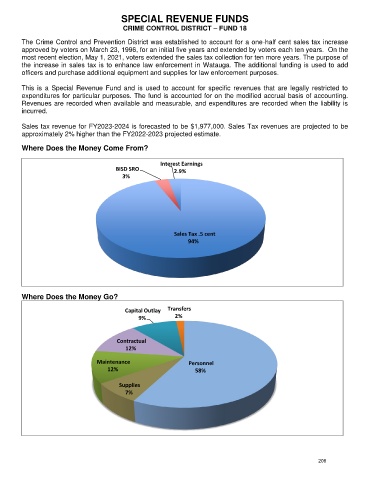

Where Does the Money Come From?

Interest Earnings

BISD SRO 2.9%

3%

Sales Tax .5 cent

94%

Where Does the Money Go?

Capital Outlay Transfers

9% 2%

Contractual

12%

Maintenance Personnel

12% 58%

Supplies

7%

208