Page 162 - CityofHaltomFY24Budget

P. 162

City Of Haltom City Annual Budget, Fy2024 Supplemental Information City Of Haltom City Annual Budget, Fy2024 Supplemental Information

PROPRIETARY FUND TYPES: ACCOUNTING SYSTEM AND BUDGETARY CONTROL

Enterprise / Business-Type Funds

This fund type is used to account for the provision of fee-based services to residents of the City. +DOWRP &LW\¶V DFFRXQWLQJ DQG ILQDQFLDO UHSRUWLQJ V\VWHP IROORZV WKH SULQFLSOHV HVWDEOLVKHG E\

These funds include the Water and Sewer Fund and the Drainage Fund. All activities necessary WKH Governmental Accounting Standards Board *$6% DQG *)2$ V EHVW SUDFWLFHV. An

to provide such services are accounted for in this fund, including, but not limited to, public works annual audit of the City’s system is performed E\ DQ LQGHSHQGHQW SXEOLF DFFRXQWLQJ ILUP ZLWK

DGPLQLVWUDWLRQ HQYLURQPHQW VHUYLFHV RSHUDWLRQV PDLQWHQDQFH ¿QDQFLQJ DQG UHODWHG GHEW WKH VXEVHTXHQW LVVXDQFH RI D $QQXDO &RPSUHKHQVLYH )LQDQFLDO 5HSRUW

service. Billing and collection services are shared between the two funds. Operation oversight

of the Enterprise Funds is the responsibility of Public Works. Utility Billing and Collection is a The &LW\ V JRYHUQPHQWDO DQG SURSULHWDU\ IXQGV are groupHG E\ W\SH (ach fund are self-

function of the Finance Department. balancing ZLWK accounts FRPSULVLQJ RI assets, GHIHUUHG RXWIORZ RI UHVRXUFHV liabilities,

GHIHUUHG LQIORZV RI UHVRXUFHV retained earnings/fund balance, revenues and expenses/

expenditures 7KH &LW\¶V DFFRXQWLQJ UHFRUGV IRU WKH :DWHU DQG 6HZHU )XQG and the Drainage

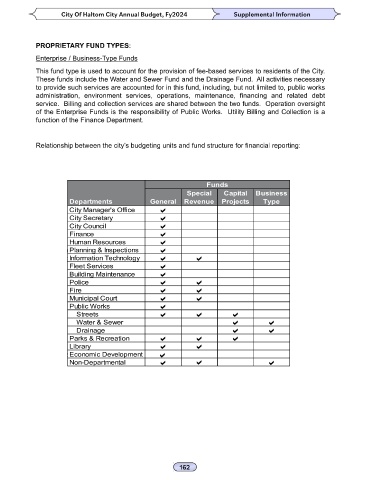

5HODWLRQVKLS EHWZHHQ WKH FLW\¶V EXGJHWLQJ XQLWV DQG IXQG VWUXFWXUH IRU ¿QDQFLDO UHSRUWLQJ )XQGV SURSULHWDU\ IXQGV are maintained on an accrual basis whereby revenues and expenses

are recorded in the accounting period in which they are earned or incurred. The remainder of

the &LW\¶V IXQGV DUH PDLQWDLQHG RQ WKH PRGLILHG DFFUXDO EDVLV ZKHUHE\ UHYHQXH LV UHFRUGHG

ZKHQ measurable and available and expenditures are recorded when the liability is incurred

except for interest on general long-term debt.

Funds 2QH RI WKH REMHFWLYHV RI WKH &LW\¶V ILQDQFLDO DFFRXQWLQJ V\VWHP LV WR SURYLGH LQWHUQDO FRQWUROV

Special Capital Business Internal controls are designed to provide reasonable, but not absolute, assurance regarding

Departments General Revenue Projects Type the safeguarding of assets against loss from unauthorized use or disposition and the

City Manager's Office D reliability of ILQDQFLDO UHFRUGV IRU SUHSDULQJ ILQDQFLDO VWDWHPHQWV DQG PDLQWDLQLQJ

City Secretary D DFFRXQWDELOLW\ IRU DVVHWV The concept of reasonable assurance recognizes that the cost of a

City Council D control should not exceed WKH EHQHILWV OLNHO\ WR EH GHULYHG DQG WKH HYDOXDWLRQ RI FRVWV DQG

Finance D EHQHILWV UHTXLUHV HVWLPDWHV DQG judgment by management.

Human Resources D

Planning & Inspections D Budgetary Control is accomplished by the adoption of an annual operating budget for various

Information Technology D D funds of the City. Detail control is accomplished by maintaining appropriations and expended

Fleet Services D balances by line item account within each operating department within each budgeted

Building Maintenance D fund. Purchase orders or payments that would result in an over expenditure of a line item

Police D D account are not processed without the approval of the Finance Director or the City Manager.

Fire D D

Municipal Court D D

Public Works D BASIS OF BUDGETING

Streets D D D

Water & Sewer D D 7KH ILQDQFLDO GDWD WKURXJKRXW WKLV GRFXPHQW IRU DOO IXQGV LV SUHVHQWHG E\ XVLQJ D FDVK EDVLV

Drainage D D of budgeting. This means that expenditures and revenues are measured and forecasted

Parks & Recreation D D D on DQ LQIORZ RXWIORZ EDVLV IRU WKH PRQWKV WKDW FRPSULVH WKH EXGJHW \HDU &DSLWDO RXWOD\

Library D D DQG debt service are included in the Water and Sewer Fund budget as a budgetary control of

Economic Development D cash expenditures. Under Generally Accepted Accounting Principles (GAAP), these items

Non-Departmental D D D will be reported as additions to capitalized assets and as a reduction of a liability, respectively.

Certain accounting adjustments based on GAAP will be applied when the City closes its

books for the year but these types of adjustments are not part of the budget presentation.

The application of *$$3 IRUPV WKH EDVLV RI DFFRXQWLQJ IRU WKH FLW\ XVLQJ WKH FDVK DFFUXDO DQG

PRGLILHG DFFUXDO PHWKRGV RI UHYHQXH DQG H[SHQGLWXUH PHDVXUHPHQW :KHUH DSSOLFDEOH WKH

HIIHFW RI WKHVH HQG of-year adjustments for historical data has been reversed to maintain the

cash basis of budgeting consistently throughout the document.