Page 166 - CityofHaltomFY24Budget

P. 166

City Of Haltom City Annual Budget, Fy2024 Supplemental Information City Of Haltom City Annual Budget, Fy2024 Supplemental Information

MULTI-YEAR FINANCIAL OUTLOOK: HALTOM CITY

Governmental Activities:

Haltom City’s Multi-Year Financial Outlook underscores a strategic and proactive approach to

financial management, acknowledging both the successes and challenges posed by the evolving

economic landscape. Despite a consistent reduction in property tax rates over the past seven years,

the city remains optimistic about a 6% increase in revenue primarily driven by strong commercial

and economic growth. MULTI-YEAR FINANCIAL OUTLOOK

GENERAL FUND

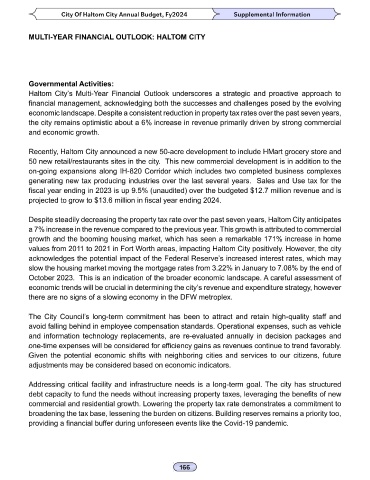

Recently, Haltom City announced a new 50-acre development to include HMart grocery store and Budgeted Projected Projected Projected Projected

2025

2028

2024

2027

2026

50 new retail/restaurants sites in the city. This new commercial development is in addition to the Fund Balance, Beginning 27,089,103 21,125,598 19,863,951 18,936,012 17,946,255

on-going expansions along IH-820 Corridor which includes two completed business complexes REVENUES

generating new tax producing industries over the last several years. Sales and Use tax for the Property Taxes $13,290,015 $13,755,165 $14,236,596 $14,734,877 $15,250,597

fiscal year ending in 2023 is up 9.5% (unaudited) over the budgeted $12.7 million revenue and is Sales & Other Taxes $13,660,000 15,026,000 15,777,300 16,566,165 17,394,473

3,726,450

3,912,773

$3,380,000

3,549,000

4,108,411

Franchise Fees

projected to grow to $13.6 million in fiscal year ending 2024. Licenses & Permits $1,058,700 1,111,635 1,167,217 1,225,578 1,286,856

Charges For Services $1,851,573 1,944,152 2,041,359 2,143,427 2,250,599

Despite steadily decreasing the property tax rate over the past seven years, Haltom City anticipates Fines and Fees $915,024 960,775 970,383 980,087 989,888

$932,190

a 7% increase in the revenue compared to the previous year. This growth is attributed to commercial Other Revenues $3,107,976 936,851 941,535 946,243 950,974

3,120,420

3,114,192

3,126,661

3,132,914

Transfers

growth and the booming housing market, which has seen a remarkable 171% increase in home Total Revenues $38,195,478 $40,397,770 $41,981,260 $43,635,810 $45,364,713

values from 2011 to 2021 in Fort Worth areas, impacting Haltom City positively. However, the city Percent increase/(decrease) from previous year 12.9% 5.8% 3.9% 3.9% 4.0%

acknowledges the potential impact of the Federal Reserve’s increased interest rates, which may

slow the housing market moving the mortgage rates from 3.22% in January to 7.08% by the end of EXPENDITURES $44,158,982 $41,659,417 $42,909,199 $44,625,567 $46,410,590

4.0%

3.0%

4.0%

Percent increase/(decrease) from previous year

10.9%

-5.7%

October 2023. This is an indication of the broader economic landscape. A careful assessment of

economic trends will be crucial in determining the city’s revenue and expenditure strategy, however Revenues Over/(Under) Expenditures (5,963,504) (1,261,647) (927,939) (989,758) (1,045,877)

there are no signs of a slowing economy in the DFW metroplex.

Reserved (i.e. Encumbrances, Prepaids etc..) (9,399,027) (8,544,570) (6,572,746) (5,477,288) (4,564,407)

The City Council’s long-term commitment has been to attract and retain high-quality staff and ENDING FUND BALANCE 11,726,571 11,319,381 12,363,266 12,468,966 12,335,971

avoid falling behind in employee compensation standards. Operational expenses, such as vehicle

and information technology replacements, are re-evaluated annually in decision packages and Fund Balance Target (20% Expenditures) $8,831,796 $8,331,883 $8,581,840 $8,925,113 $9,282,118

one-time expenses will be considered for efficiency gains as revenues continue to trend favorably.

Given the potential economic shifts with neighboring cities and services to our citizens, future Percent of current year Expenditures 27% 27% 29% 28% 27%

adjustments may be considered based on economic indicators.

Addressing critical facility and infrastructure needs is a long-term goal. The city has structured

debt capacity to fund the needs without increasing property taxes, leveraging the benefits of new

commercial and residential growth. Lowering the property tax rate demonstrates a commitment to

broadening the tax base, lessening the burden on citizens. Building reserves remains a priority too,

providing a financial buffer during unforeseen events like the Covid-19 pandemic.