Page 226 - ArlingtonFY24AdoptedBudget

P. 226

Debt Service Fund

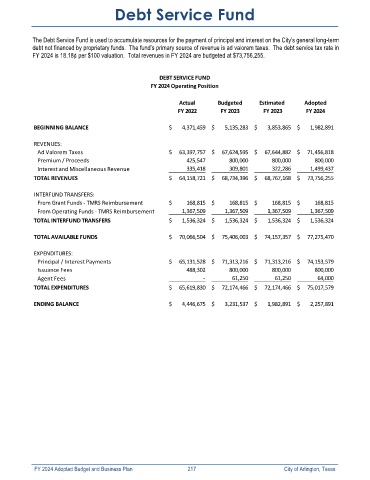

The Debt Service Fund is used to accumulate resources for the payment of principal and interest on the City’s general long-term

debt not financed by proprietary funds. The fund’s primary source of revenue is ad valorem taxes. The debt service tax rate in

FY 2024 is 18.18¢ per $100 valuation. Total revenues in FY 2024 are budgeted at $73,756,255.

DEBT SERVICE FUND

FY 2024 Operating Position

Actual Budgeted Estimated Adopted

FY 2022 FY 2023 FY 2023 FY 2024

BEGINNING BALANCE $ 4,371,459 $ 5,135,283 $ 3,853,865 $ 1,982,891

REVENUES:

Ad Valorem Taxes $ 63,397,757 $ 67,624,595 $ 67,644,882 $ 71,456,818

Premium / Proceeds 425,547 800,000 800,000 800,000

Interest and Miscellaneous Revenue 335,418 309,801 322,286 1,499,437

TOTAL REVENUES $ 64,158,721 $ 68,734,396 $ 68,767,168 $ 73,756,255

INTERFUND TRANSFERS:

From Grant Funds - TMRS Reimbursement $ 168,815 $ 168,815 $ 168,815 $ 168,815

From Operating Funds - TMRS Reimbursement 1,367,509 1,367,509 1,367,509 1,367,509

TOTAL INTERFUND TRANSFERS $ 1,536,324 $ 1,536,324 $ 1,536,324 $ 1,536,324

TOTAL AVAILABLE FUNDS $ 70,066,504 $ 75,406,003 $ 74,157,357 $ 77,275,470

EXPENDITURES:

Principal / Interest Payments $ 65,131,528 $ 71,313,216 $ 71,313,216 $ 74,153,579

Issuance Fees 488,302 800,000 800,000 800,000

Agent Fees - 61,250 61,250 64,000

TOTAL EXPENDITURES $ 65,619,830 $ 72,174,466 $ 72,174,466 $ 75,017,579

ENDING BALANCE $ 4,446,675 $ 3,231,537 $ 1,982,891 $ 2,257,891

FY 2024 Adopted Budget and Business Plan 217 City of Arlington, Texas