Page 280 - Southlake FY23 Budget

P. 280

Sales Tax Districts

Southlake ParkS develoPment CorPoration (SPdC)

fund

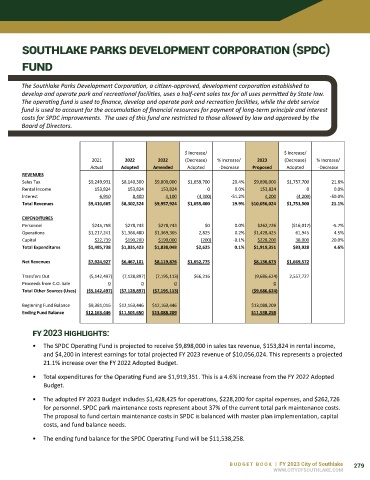

The Southlake Parks Development Corporation, a citizen-approved, development corporation established to

develop and operate park and recreational facilities, uses a half-cent sales tax for all uses permitted by State law.

The operating fund is used to finance, develop and operate park and recreation facilities, while the debt service

SPDC - OPERATING FUND

fund is used to account for the accumulation of financial resources for payment of long-term principle and interest

Parks/Recreation

costs for SPDC improvements. The uses of this fund are restricted to those allowed by law and approved by the

Board of Directors. 2023 Proposed and 2022 Revised Budget

$ Increase/ $ Increase/

2021 2022 2022 (Decrease) % Increase/ 2023 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Sales Tax $9,249,931 $8,140,300 $9,800,000 $1,659,700 20.4% $9,898,000 $1,757,700 21.6%

Rental Income 153,824 153,824 153,824 0 0.0% 153,824 0 0.0%

Interest 6,910 8,400 4,100 (4,300) -51.2% 4,200 (4,200) -50.0%

Total Revenues $9,410,665 $8,302,524 $9,957,924 $1,655,400 19.9% $10,056,024 $1,753,500 21.1%

EXPENDITURES

Personnel $245,758 $278,743 $278,743 $0 0.0% $262,726 ($16,017) -5.7%

Operations $1,217,241 $1,366,480 $1,369,305 2,825 0.2% $1,428,425 61,945 4.5%

Capital $22,739 $190,200 $190,000 (200) -0.1% $228,200 38,000 20.0%

Total Expenditures $1,485,738 $1,835,423 $1,838,048 $2,625 0.1% $1,919,351 $83,928 4.6%

Net Revenues $7,924,927 $6,467,101 $8,119,876 $1,652,775 $8,136,673 $1,669,572

Transfers Out (5,142,497) (7,128,897) (7,195,113) $66,216 (9,686,624) 2,557,727

Proceeds from C.O. Sale 0 0 0 0

Total Other Sources (Uses) ($5,142,497) ($7,128,897) ($7,195,113) ($9,686,624)

Beginning Fund Balance $9,381,016 $12,163,446 $12,163,446 $13,088,209

Ending Fund Balance $12,163,446 $11,501,650 $13,088,209 $11,538,258

fy 2023 highlightS:

• The SPDC Operating Fund is projected to receive $9,898,000 in sales tax revenue, $153,824 in rental income,

and $4,200 in interest earnings for total projected FY 2023 revenue of $10,056,024. This represents a projected

21.1% increase over the FY 2022 Adopted Budget.

• Total expenditures for the Operating Fund are $1,919,351. This is a 4.6% increase from the FY 2022 Adopted

Budget.

• The adopted FY 2023 Budget includes $1,428,425 for operations, $228,200 for capital expenses, and $262,726

for personnel. SPDC park maintenance costs represent about 37% of the current total park maintenance costs.

The proposal to fund certain maintenance costs in SPDC is balanced with master plan implementation, capital

costs, and fund balance needs.

• The ending fund balance for the SPDC Operating Fund will be $11,538,258.

BUDGET BOOK | FY 2023 City of Southlake 279

WWW.CITYOFSOUTHLAKE.COM