Page 282 - Southlake FY23 Budget

P. 282

Sales Tax Districts

Community enhanCement and develoPment

CorPoration fund

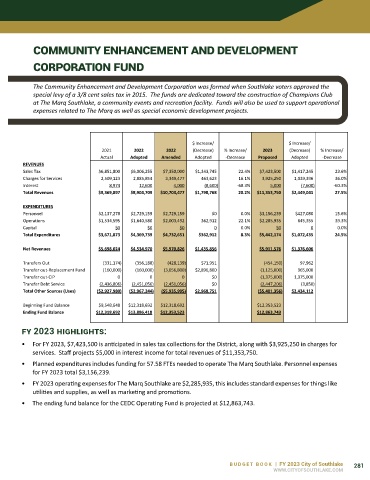

The Community Enhancement and Development Corporation was formed when Southlake voters approved the

special levy of a 3/8 cent sales tax in 2015. The funds are dedicated toward the construction of Champions Club

CEDC - OPERATING FUND

at The Marq Southlake, a community events and recreation facility. Funds will also be used to support operational

Parks/Recreation

expenses related to The Marq as well as special economic development projects.

2023 Proposed and 2022 Revised Budget

$ Increase/ $ Increase/

2021 2022 2022 (Decrease) % Increase/ 2023 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Sales Tax $6,851,800 $6,006,255 $7,350,000 $1,343,745 22.4% $7,423,500 $1,417,245 23.6%

Charges for Services 2,509,123 2,885,854 3,349,477 463,623 16.1% 3,925,250 1,039,396 36.0%

Interest 8,974 12,600 4,000 (8,600) -68.3% 5,000 (7,600) -60.3%

Total Revenues $9,369,897 $8,904,709 $10,703,477 $1,798,768 20.2% $11,353,750 $2,449,041 27.5%

EXPENDITURES

Personnel $2,137,278 $2,729,159 $2,729,159 $0 0.0% $3,156,239 $427,080 15.6%

Operations $1,534,595 $1,640,580 $2,003,492 362,912 22.1% $2,285,935 645,355 39.3%

Capital $0 $0 $0 0 0.0% $0 0 0.0%

Total Expenditures $3,671,873 $4,369,739 $4,732,651 $362,912 8.3% $5,442,174 $1,072,435 24.5%

Net Revenues $5,698,024 $4,534,970 $5,970,826 $1,435,856 $5,911,576 $1,376,606

Transfers Out (331,174) (356,188) (428,139) $71,951 (454,150) 97,962

Transfer out-Replacement Fund (160,000) (160,000) (3,056,800) $2,896,800 (1,125,000) 965,000

Transfer out-CIP 0 0 0 $0 (1,375,000) 1,375,000

Transfer Debt Service (2,436,806) (2,451,056) (2,451,056) $0 (2,447,206) (3,850)

Total Other Sources (Uses) ($2,927,980) ($2,967,244) ($5,935,995) $2,968,751 ($5,401,356) $2,434,112

Beginning Fund Balance $9,548,648 $12,318,692 $12,318,692 $12,353,523

Ending Fund Balance $12,318,692 $13,886,418 $12,353,523 $12,863,743

fy 2023 highlightS:

• For FY 2023, $7,423,500 is anticipated in sales tax collections for the District, along with $3,925,250 in charges for

services. Staff projects $5,000 in interest income for total revenues of $11,353,750.

• Planned expenditures includes funding for 57.58 FTEs needed to operate The Marq Southlake. Personnel expenses

for FY 2023 total $3,156,239.

• FY 2023 operating expenses for The Marq Southlake are $2,285,935, this includes standard expenses for things like

utilities and supplies, as well as marketing and promotions.

• The ending fund balance for the CEDC Operating Fund is projected at $12,863,743.

BUDGET BOOK | FY 2023 City of Southlake 281

WWW.CITYOFSOUTHLAKE.COM