Page 276 - Southlake FY23 Budget

P. 276

Sales Tax Districts

SaleS tax diStriCtS

As with all other special revenue funds, sales tax districts Southlake SaleS tax diStriCtS

revenues are designated for specific purposes. State law

regulates both the types of sales tax districts cities may

utilize and the use of their funds, and the final approval of

all sales tax districts is up to the voters. In Southlake, the

total sales tax rate is 8.25%. Of that, the City receives a

$0.02 of sales tax for every dollar spent in our city limits (the

remainder goes to the State).

One of those pennies goes to the General Fund and can

be spent on general operating costs, like supplies, salaries,

and general maintenance. The other penny is split between our Crime Control and Prevention District (CCPD),

the Southlake Parks Development Corporation (SPDC), and the Community Enhancement and Development

Corporation (CEDC). The money collected in these districts can only be used for the purposes outlined in the

original referendum presented to the voters, so we set up separate funds to account for the revenues and

expenditures of each unit.

How does sales tax

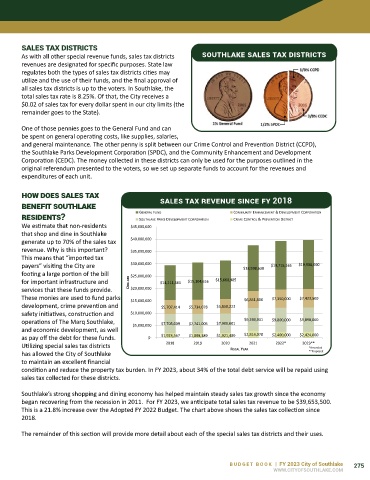

benefIt soutHlake SaleS tax revenue SinCe fy 2018

resIdents? GENERAL FUND COMMUNITY ENHANCEMENT & DEVELOPMENT CORPORATION

CRIME CONTROL & PREVENTION DISTRICT

SOUTHLAKE PARKS DEVELOPMENT CORPORATION

We estimate that non-residents $45,000,000

that shop and dine in Southlake

generate up to 70% of the sales tax $40,000,000

revenue. Why is this important? $35,000,000

This means that “imported tax

payers” visiting the City are $30,000,000 $18,598,638 $19,715,165 $19,908,000

footing a large portion of the bill $25,000,000

for important infrastructure and DOLLARS $14,111,661 $15,104,616 $15,660,985

services that these funds provide. $20,000,000

These monies are used to fund parks $15,000,000 $6,851,800 $7,350,000 $7,423,500

development, crime prevention and $5,707,414 $5,734,078 $5,858,223

safety initiatives, construction and $10,000,000

operations of The Marq Southlake, $7,705,009 $7,741,005 $7,908,601 $9,249,931 $9,800,000 $9,898,000

and economic development, as well $5,000,000

as pay off the debt for these funds. $- $1,923,567 $1,898,389 $1,921,480 $2,814,078 $2,400,000 $2,424,000

Utilizing special sales tax districts 2018 2019 2020 FISCAL YEAR 2021 2022* 2023**

*Amended

has allowed the City of Southlake **Proposed

to maintain an excellent financial

condition and reduce the property tax burden. In FY 2023, about 34% of the total debt service will be repaid using

sales tax collected for these districts.

Southlake’s strong shopping and dining economy has helped maintain steady sales tax growth since the economy

began recovering from the recession in 2011. For FY 2023, we anticipate total sales tax revenue to be $39,653,500.

This is a 21.8% increase over the Adopted FY 2022 Budget. The chart above shows the sales tax collection since

2018.

The remainder of this section will provide more detail about each of the special sales tax districts and their uses.

BUDGET BOOK | FY 2023 City of Southlake 275

WWW.CITYOFSOUTHLAKE.COM