Page 271 - Southlake FY23 Budget

P. 271

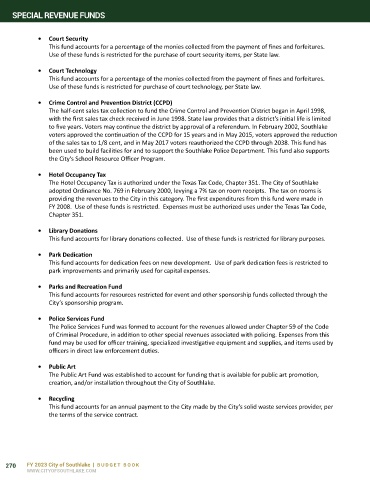

SPECIAL REVENUE FUNDS

• Court Security

This fund accounts for a percentage of the monies collected from the payment of fines and forfeitures.

Use of these funds is restricted for the purchase of court security items, per State law.

• Court Technology

This fund accounts for a percentage of the monies collected from the payment of fines and forfeitures.

Use of these funds is restricted for purchase of court technology, per State law.

• Crime Control and Prevention District (CCPD)

The half-cent sales tax collection to fund the Crime Control and Prevention District began in April 1998,

with the first sales tax check received in June 1998. State law provides that a district’s initial life is limited

to five years. Voters may continue the district by approval of a referendum. In February 2002, Southlake

voters approved the continuation of the CCPD for 15 years and in May 2015, voters approved the reduction

of the sales tax to 1/8 cent, and in May 2017 voters reauthorized the CCPD through 2038. This fund has

been used to build facilities for and to support the Southlake Police Department. This fund also supports

the City’s School Resource Officer Program.

• Hotel Occupancy Tax

The Hotel Occupancy Tax is authorized under the Texas Tax Code, Chapter 351. The City of Southlake

adopted Ordinance No. 769 in February 2000, levying a 7% tax on room receipts. The tax on rooms is

providing the revenues to the City in this category. The first expenditures from this fund were made in

FY 2008. Use of these funds is restricted. Expenses must be authorized uses under the Texas Tax Code,

Chapter 351.

• Library Donations

This fund accounts for library donations collected. Use of these funds is restricted for library purposes.

• Park Dedication

This fund accounts for dedication fees on new development. Use of park dedication fees is restricted to

park improvements and primarily used for capital expenses.

• Parks and Recreation Fund

This fund accounts for resources restricted for event and other sponsorship funds collected through the

City’s sponsorship program.

• Police Services Fund

The Police Services Fund was formed to account for the revenues allowed under Chapter 59 of the Code

of Criminal Procedure, in addition to other special revenues associated with policing. Expenses from this

fund may be used for officer training, specialized investigative equipment and supplies, and items used by

officers in direct law enforcement duties.

• Public Art

The Public Art Fund was established to account for funding that is available for public art promotion,

creation, and/or installation throughout the City of Southlake.

• Recycling

This fund accounts for an annual payment to the City made by the City’s solid waste services provider, per

the terms of the service contract.

270 FY 2023 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM