Page 422 - Bedford-FY22-23 Budget

P. 422

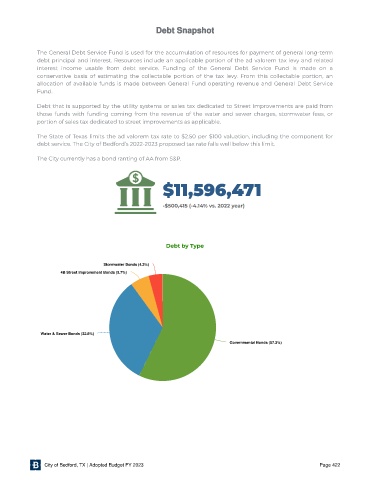

Debt Snapshot

The General Debt Service Fund is used for the accumulation of resources for payment of general long-term

debt principal and interest. Resources include an applicable portion of the ad valorem tax levy and related

interest income usable from debt service. Funding of the General Debt Service Fund is made on a

conservative basis of estimating the collectable portion of the tax levy. From this collectable portion, an

allocation of available funds is made between General Fund operating revenue and General Debt Service

Fund.

Debt that is supported by the utility systems or sales tax dedicated to Street Improvements are paid from

those funds with funding coming from the revenue of the water and sewer charges, stormwater fees, or

portion of sales tax dedicated to street improvements as applicable.

The State of Texas limits the ad valorem tax rate to $2.50 per $100 valuation, including the component for

debt service. The City of Bedford’s 2022-2023 proposed tax rate falls well below this limit.

The City currently has a bond ranting of AA from S&P.

B11,596,471

-$500,415 (-4 .14% vs. 2022 year)

Debt by Type

S

w

S t t o o r r m w a a t t e e r r B B o o n n d d s s ( ( 4 4 . . 2 2 % ) )

Stormwater Bonds (4.2%)

m

%

o

n

B

B

o

e

n

m

e

n

t

t

.

.

5

5

%

%

7

7

(

d

s

n

d

(

s

m

r

r

t

t

e

e

t

e

e

4

B

4B Street Improvement Bonds (5.7%) ) )

4

B

S

S

o

o

r

r

e

e

v

v

p

I

t

I

p

m

m

W a a t t e e r r & & S S e e w w e e r r B o o n n d d s s ( ( 3 3 2 2 . . 8 8 % ) )

Water & Sewer Bonds (32.8%)

W

B

%

d

d

n

s

s

n

B

o

o

B

3

.

.

%

%

3

7

(

(

7

5

5

e

e

v

n

r

r

G

G

Governmental Bonds (57.3%) ) )

v

o

o

n

a

t

t

l

l

a

e

m

m

n

n

e

City of Bedford, TX | Adopted Budget FY 2023 Page 422