Page 16 - City of Westworth Village FY22 Budget

P. 16

16

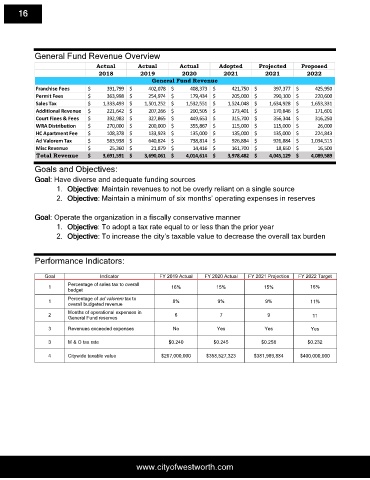

General Fund Revenue Overview

Actual Actual Actual Adopted Projected Proposed

2018 2019 2020 2021 2021 2022

General Fund Revenue

Franchise Fees $ 391,799 $ 402,078 $ 408,373 $ 421,750 $ 397,377 $ 425,950

Permit Fees $ 363,998 $ 254,974 $ 179,434 $ 205,000 $ 290,100 $ 220,600

Sales Tax $ 1,333,493 $ 1,501,252 $ 1,532,551 $ 1,524,048 $ 1,634,928 $ 1,653,331

Additional Revenue $ 221,642 $ 207,266 $ 200,505 $ 173,401 $ 170,846 $ 171,601

Court Fines & Fees $ 392,983 $ 327,865 $ 449,653 $ 315,700 $ 356,344 $ 316,250

WRA Distribution $ 270,000 $ 200,000 $ 355,867 $ 115,000 $ 115,000 $ 26,000

HC Apartment Fee $ 108,378 $ 133,923 $ 135,000 $ 135,000 $ 135,000 $ 224,843

Ad Valorem Tax $ 583,938 $ 640,824 $ 738,814 $ 926,884 $ 926,884 $ 1,034,515

Misc Revenue $ 25,360 $ 21,879 $ 14,416 $ 161,700 $ 18,650 $ 16,500

Total Revenue $ 3,691,591 $ 3,690,061 $ 4,014,614 $ 3,978,482 $ 4,045,129 $ 4,089,589

Goals and Objectives:

Goal: Have diverse and adequate funding sources

1. Objective: Maintain revenues to not be overly reliant on a single source

2. Objective: Maintain a minimum of six months’ operating expenses in reserves

Goal: Operate the organization in a fiscally conservative manner

1. Objective: To adopt a tax rate equal to or less than the prior year

2. Objective: To increase the city’s taxable value to decrease the overall tax burden

Performance Indicators:

Goal Indicator FY 2019 Actual FY 2020 Actual FY 2021 Projection FY 2022 Target

Percentage of sales tax to overall

1 16% 15% 15% 16%

budget

Percentage of ad valorem tax to

1 8% 9% 9% 11%

overall budgeted revenue

Months of operational expenses in

2 6 7 9 11

General Fund reserves

3 Revenues exceeded expenses No Yes Yes Yes

3 M & O tax rate $0.240 $0.245 $0.258 $0.232

4 Citywide taxable value $267,000,000 $358,527,323 $381,989,884 $400,000,000

www.cityofwestworth.com