Page 38 - PowerPoint Presentation

P. 38

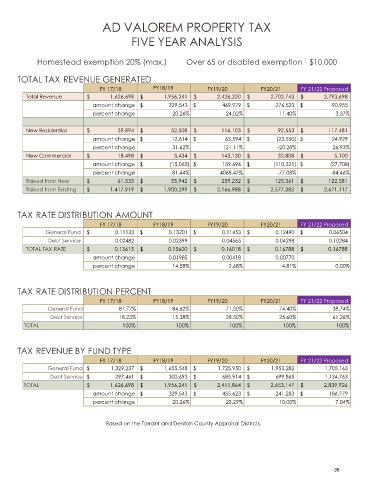

AD VALOREM PROPERTY TAX

FIVE YEAR ANALYSIS

Homestead exemption 20% (max.) Over 65 or disabled exemption - $10,000

TOTAL TAX REVENUE GENERATED

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

Total Revenue $ 1,626,698 $ 1,956,241 $ 2,426,220 $ 2,702,743 $ 2,793,698

amount change $ 329,543 $ 469,979 $ 276,523 $ 90,955

percent change 20.26% 24.02% 11.40% 3.37%

New Residential $ 39,894 $ 52,508 $ 116,103 $ 92,553 $ 117,481

amount change $ 12,614 $ 63,594 $ (23,550) $ 24,929

percent change 31.62% 121.11% -20.28% 26.93%

New Commercial $ 18,498 $ 3,434 $ 143,130 $ 32,808 $ 5,100

amount change $ (15,065) $ 139,696 $ (110,321) $ (27,708)

percent change -81.44% 4068.47% -77.08% -84.46%

Raised from New $ 61,533 $ 55,942 $ 259,232 $ 125,361 $ 122,581

Raised from Existing $ 1,417,919 $ 1,900,299 $ 2,166,988 $ 2,577,382 $ 2,671,117

TAX RATE DISTRIBUTION AMOUNT

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

General Fund $ 0.11133 $ 0.13201 $ 0.11453 $ 0.12490 $ 0.06504

Debt Service 0.02482 0.02399 0.04565 0.04298 0.10284

TOTAL TAX RATE $ 0.13615 $ 0.15600 $ 0.16018 $ 0.16788 $ 0.16788

0.15634 amount change 0.01985 0.00418 0.00770 -

percent change 14.58% 2.68% 4.81% 0.00%

TAX RATE DISTRIBUTION PERCENT

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

General Fund 81.77% 84.62% 71.50% 74.40% 38.74%

Debt Service 18.23% 15.38% 28.50% 25.60% 61.26%

TOTAL 100% 100% 100% 100% 100%

TAX REVENUE BY FUND TYPE

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

General Fund $ 1,329,237 $ 1,655,548 $ 1,725,950 $ 1,953,282 1,705,163

Debt Service $ 297,461 $ 300,693 $ 685,914 $ 699,865 1,134,763

TOTAL $ 1,626,698 $ 1,956,241 $ 2,411,864 $ 2,653,147 $ 2,839,926

amount change $ 329,543 $ 455,623 $ 241,283 $ 186,779

percent change 20.26% 23.29% 10.00% 7.04%

Based on the Tarrant and Denton County Appraisal Districts.

36