Page 36 - PowerPoint Presentation

P. 36

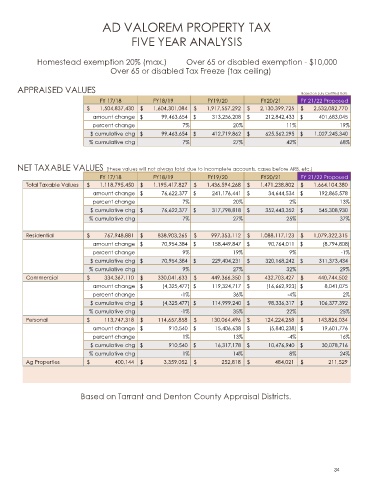

AD VALOREM PROPERTY TAX

FIVE YEAR ANALYSIS

Homestead exemption 20% (max.) Over 65 or disabled exemption - $10,000

Over 65 or disabled Tax Freeze (tax ceiling)

APPRAISED VALUES Based on July Certified Rolls

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

$ 1,504,837,430 $ 1,604,301,084 $ 1,917,557,292 $ 2,130,399,725 $ 2,532,082,770

amount change $ 99,463,654 $ 313,256,208 $ 212,842,433 $ 401,683,045

percent change 7% 20% 11% 19%

$ cumulative chg $ 99,463,654 $ 412,719,862 $ 625,562,295 $ 1,027,245,340

% cumulative chg 7% 27% 42% 68%

NET TAXABLE VALUES (these values will not always total due to incomplete accounts, cases before ARB, etc.)

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

Total Taxable Values $ 1,118,795,450 $ 1,195,417,827 $ 1,436,594,268 $ 1,471,238,802 $ 1,664,104,380

amount change $ 76,622,377 $ 241,176,441 $ 34,644,534 $ 192,865,578

percent change 7% 20% 2% 13%

$ cumulative chg $ 76,622,377 $ 317,798,818 $ 352,443,352 $ 545,308,930

% cumulative chg 7% 27% 25% 37%

Residential $ 767,948,881 $ 838,903,265 $ 997,353,112 $ 1,088,117,123 $ 1,079,322,315

amount change $ 70,954,384 $ 158,449,847 $ 90,764,011 $ (8,794,808)

percent change 9% 19% 9% -1%

$ cumulative chg $ 70,954,384 $ 229,404,231 $ 320,168,242 $ 311,373,434

% cumulative chg 9% 27% 32% 29%

Commercial $ 334,367,110 $ 330,041,633 $ 449,366,350 $ 432,703,427 $ 440,744,502

amount change $ (4,325,477) $ 119,324,717 $ (16,662,923) $ 8,041,075

percent change -1% 36% -4% 2%

$ cumulative chg $ (4,325,477) $ 114,999,240 $ 98,336,317 $ 106,377,392

% cumulative chg -1% 35% 22% 25%

Personal $ 113,747,318 $ 114,657,858 $ 130,064,496 $ 124,224,258 $ 143,826,034

amount change $ 910,540 $ 15,406,638 $ (5,840,238) $ 19,601,776

percent change 1% 13% -4% 16%

$ cumulative chg $ 910,540 $ 16,317,178 $ 10,476,940 $ 30,078,716

% cumulative chg 1% 14% 8% 24%

Ag Properties $ 400,144 $ 3,359,052 $ 252,818 $ 484,021 $ 211,529

Based on Tarrant and Denton County Appraisal Districts.

34