Page 37 - PowerPoint Presentation

P. 37

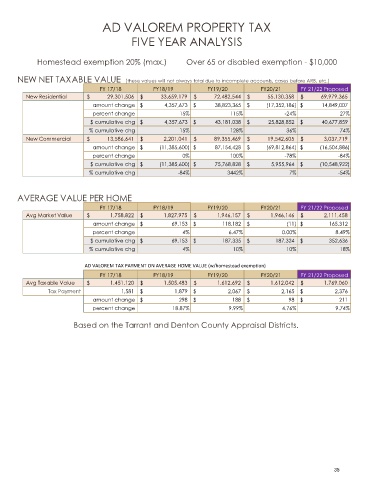

AD VALOREM PROPERTY TAX

FIVE YEAR ANALYSIS

Homestead exemption 20% (max.) Over 65 or disabled exemption - $10,000

NEW NET TAXABLE VALUE (these values will not always total due to incomplete accounts, cases before ARB, etc.)

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

New Residential $ 29,301,506 $ 33,659,179 $ 72,482,544 $ 55,130,358 $ 69,979,365

amount change $ 4,357,673 $ 38,823,365 $ (17,352,186) $ 14,849,007

percent change 15% 115% -24% 27%

$ cumulative chg $ 4,357,673 $ 43,181,038 $ 25,828,852 $ 40,677,859

% cumulative chg 15% 128% 36% 74%

New Commercial $ 13,586,641 $ 2,201,041 $ 89,355,469 $ 19,542,605 $ 3,037,719

amount change $ (11,385,600) $ 87,154,428 $ (69,812,864) $ (16,504,886)

percent change 0% 100% -78% -84%

$ cumulative chg $ (11,385,600) $ 75,768,828 $ 5,955,964 $ (10,548,922)

% cumulative chg -84% 3442% 7% -54%

AVERAGE VALUE PER HOME

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

Avg Market Value $ 1,758,822 $ 1,827,975 $ 1,946,157 $ 1,946,146 $ 2,111,458

amount change $ 69,153 $ 118,182 $ (11) $ 165,312

percent change 4% 6.47% 0.00% 8.49%

$ cumulative chg $ 69,153 $ 187,335 $ 187,324 $ 352,636

% cumulative chg 4% 10% 10% 18%

AD VALOREM TAX PAYMENT ON AVERAGE HOME VALUE (w/homestead exemption)

FY 17/18 FY18/19 FY19/20 FY20/21 FY 21/22 Proposed

Avg Taxable Value $ 1,451,120 $ 1,505,483 $ 1,612,692 $ 1,612,042 $ 1,769,060

Tax Payment 1,581 $ 1,879 $ 2,067 $ 2,165 $ 2,376

amount change $ 298 $ 188 $ 98 $ 211

percent change 18.87% 9.99% 4.76% 9.74%

Based on the Tarrant and Denton County Appraisal Districts.

35