Page 34 - PowerPoint Presentation

P. 34

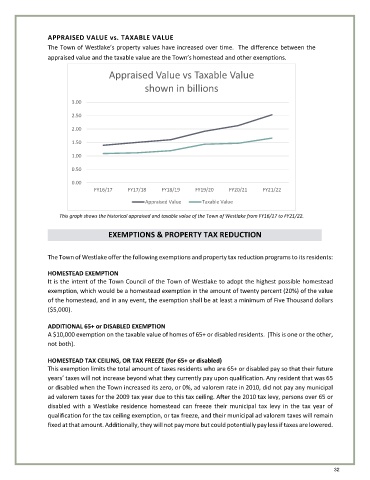

APPRAISED VALUE vs. TAXABLE VALUE

The Town of Westlake’s property values have increased over time. The difference between the

appraised value and the taxable value are the Town’s homestead and other exemptions.

Appraised Value vs Taxable Value

shown in billions

3.00

2.50

2.00

1.50

1.00

0.50

0.00

FY16/17 FY17/18 FY18/19 FY19/20 FY20/21 FY21/22

Appraised Value Taxable Value

This graph shows the historical appraised and taxable value of the Town of Westlake from FY16/17 to FY21/22.

EXEMPTIONS & PROPERTY TAX REDUCTION

The Town of Westlake offer the following exemptions and property tax reduction programs to its residents:

HOMESTEAD EXEMPTION

It is the intent of the Town Council of the Town of Westlake to adopt the highest possible homestead

exemption, which would be a homestead exemption in the amount of twenty percent (20%) of the value

of the homestead, and in any event, the exemption shall be at least a minimum of Five Thousand dollars

($5,000).

ADDITIONAL 65+ or DISABLED EXEMPTION

A $10,000 exemption on the taxable value of homes of 65+ or disabled residents. (This is one or the other,

not both).

HOMESTEAD TAX CEILING, OR TAX FREEZE (for 65+ or disabled)

This exemption limits the total amount of taxes residents who are 65+ or disabled pay so that their future

years’ taxes will not increase beyond what they currently pay upon qualification. Any resident that was 65

or disabled when the Town increased its zero, or 0%, ad valorem rate in 2010, did not pay any municipal

ad valorem taxes for the 2009 tax year due to this tax ceiling. After the 2010 tax levy, persons over 65 or

disabled with a Westlake residence homestead can freeze their municipal tax levy in the tax year of

qualification for the tax ceiling exemption, or tax freeze, and their municipal ad valorem taxes will remain

fixed at that amount. Additionally, they will not pay more but could potentially pay less if taxes are lowered.

32