Page 22 - Southlake FY22 Budget

P. 22

TrAnSMITTAL LETTEr

roll – the no new revenue tax rate

and the voter approval tax rate. The ASSESSED VALUE TAXABLE VALUE

no new revenue rate is the rate that $12,000

will generate the same amount of $10,714 $11,138

property tax dollars as the previous $11,000 $10,526

year, excluding new construction $10,000 $9,810

and annexations, when the two

years are compared. $9,000 $8,269 $8,743

If a city adopts a tax rate exceeding VALUATION IN MILLIONS OF $ $8,000 $7,323 $7,770 $7,769 $8,221

the voter approval rate (3.5 percent $7,000 $6,654 $6,760 $7,287

maintenance and operation rate $6,000 $6,369 $6,662

growth, plus “unused increment $5,785

rate”), then the city must hold an $5,000 $5,495 $5,680

automatic election. Depending on

the ultimate rate that is chosen $4,000

by the City and its relationship to $3,000

these legally defined rates, there 2014 2015 2016 2017 2018 2019 2020 2021 2022

are requirements that must be Figure 7: Comparison of property values since FY 2014 (assessed and taxable)

followed to comply with truth-in-

taxation laws. These requirements protect the public’s right-to-know concerning tax rate decisions.

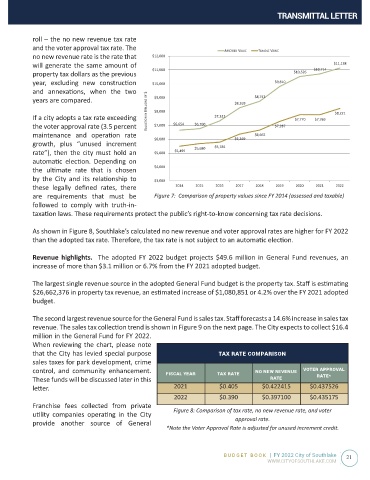

As shown in Figure 8, Southlake’s calculated no new revenue and voter approval rates are higher for FY 2022

than the adopted tax rate. Therefore, the tax rate is not subject to an automatic election.

Revenue highlights. The adopted FY 2022 budget projects $49.6 million in General Fund revenues, an

increase of more than $3.1 million or 6.7% from the FY 2021 adopted budget.

The largest single revenue source in the adopted General Fund budget is the property tax. Staff is estimating

$26,662,376 in property tax revenue, an estimated increase of $1,080,851 or 4.2% over the FY 2021 adopted

budget.

The second largest revenue source for the General Fund is sales tax. Staff forecasts a 14.6% increase in sales tax

revenue. The sales tax collection trend is shown in Figure 9 on the next page. The City expects to collect $16.4

million in the General Fund for FY 2022.

When reviewing the chart, please note

that the City has levied special purpose Tax raTe COmParisOn

sales taxes for park development, crime

control, and community enhancement. fisCal year Tax raTe nO new revenue vOTer aPPrOval

These funds will be discussed later in this raTe raTe*

letter. 2021 $0.405 $0.422415 $0.437526

2022 $0.390 $0.397100 $0.435175

Franchise fees collected from private Figure 8: Comparison of tax rate, no new revenue rate, and voter

utility companies operating in the City

provide another source of General approval rate.

*Note the Voter Approval Rate is adjusted for unused increment credit.

BUDGET BOOK | FY 2022 City of Southlake 21

WWW.CITYOFSOUTHLAKE.COM