Page 21 - Southlake FY22 Budget

P. 21

TrAnSMITTAL LETTEr

general fund

DID YOU KnOW?

The General Fund is the City’s principle operating fund,

and is supported by property tax, sales tax, fees, and other

revenues. These revenues may be used for a variety of Through the City’s use of cash and

purposes, as determined by the City Council. The General aggressive amortization schedules when

Fund budget accounts for core City services such as police debt is issued, the City has reduced the

and fire protection, engineering, planning, finance, and property tax supported debt per capita

administrative oversight. from $3,506 in 2010 to $768 in 2022.

Tax rate. The FY 2022 adopted budget incorporates a

tax rate of $0.39 per $100 valuation, reducing the rate by one and one half cent. The tax rate of $0.39 is

split between General Fund operations and debt service. The allocation for FY 2022 is $0.325 for general

operations and $0.065 for debt service.

One half cent of the tax rate reduction has been taken from the operations portion of the tax rate, and a one

cent reduction is adopted for the debt portion of the tax rate, reflecting the City’s emphasis on cash funding

General Fund capital projects.

The City has not increased its tax rate in twenty consecutive fiscal years.

The 20% homestead exemption will complement the current over-65 exemption of $75,000, disabled

exemption of $75,000, and the over-65 tax freeze. The continued use of the exemptions offset the tax value

on residential properties. The homestead exemption is set at the State-allowed maximum of 20%.

A 20% homestead exemption will reduce an average-valued home in Southlake by $158,794. The property

owner of an average-valued home will see the equivalent of a tax rate reduction of approximately eight cents

per $100 valuation with the exemption applied.

With the homestead exemption in place, and considering the tax rate reduction, the equivalent residential

tax rate on an average-valued home is $0.312.

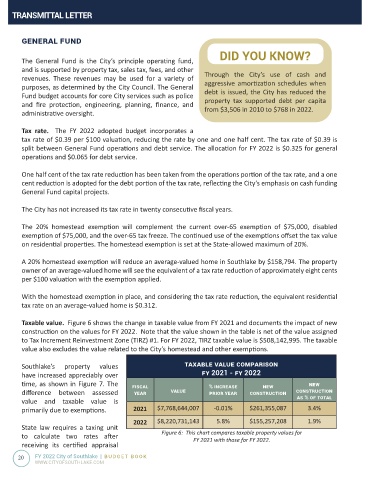

Taxable value. Figure 6 shows the change in taxable value from FY 2021 and documents the impact of new

construction on the values for FY 2022. Note that the value shown in the table is net of the value assigned

to Tax Increment Reinvestment Zone (TIRZ) #1. For FY 2022, TIRZ taxable value is $508,142,995. The taxable

value also excludes the value related to the City’s homestead and other exemptions.

Southlake’s property values TaxaBle value COmParisOn

have increased appreciably over fy 2021 - fy 2022

time, as shown in Figure 7. The fisCal % inCrease new new

difference between assessed year value PriOr year COnsTruCTiOn COnsTruCTiOn

value and taxable value is as % Of TOTal

primarily due to exemptions. 2021 $7,768,644,007 -0.01% $261,355,087 3.4%

2022 $8,220,731,143 5.8% $155,257,208 1.9%

State law requires a taxing unit

to calculate two rates after Figure 6: This chart compares taxable property values for

FY 2021 with those for FY 2022.

receiving its certified appraisal

20 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM