Page 279 - Microsoft Word - FY 2021 tax info sheet

P. 279

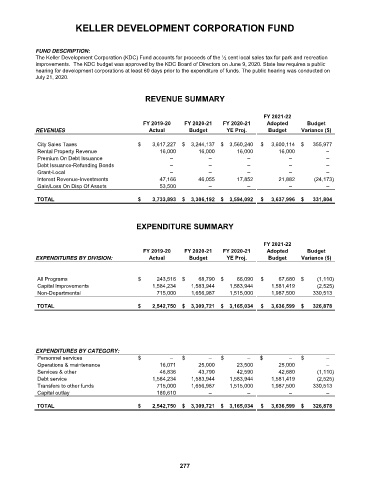

KELLER DEVELOPMENT CORPORATION FUND

FUND DESCRIPTION:

The Keller Development Corporation (KDC) Fund accounts for proceeds of the ½ cent local sales tax for park and recreation

improvements. The KDC budget was approved by the KDC Board of Directors on June 9, 2020. State law requires a public

hearing for development corporations at least 60 days prior to the expenditure of funds. The public hearing was conducted on

July 21, 2020.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

City Sales Taxes $ 3,617,227 $ 3,244,137 $ 3,560,240 $ 3,600,114 $ 355,977

Rental Property Revenue 16,000 16,000 16,000 16,000 –

Premium On Debt Issuance – – – – –

Debt Issuance-Refunding Bonds – – – – –

Grant-Local – – – – –

Interest Revenue-Investments 47,166 46,055 17,852 21,882 (24,173)

Gain/Loss On Disp Of Assets 53,500 – – – –

TOTAL $ 3,733,893 $ 3,306,192 $ 3,594,092 $ 3,637,996 $ 331,804

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY DIVISION: Actual Budget YE Proj. Budget Variance ($)

All Programs $ 243,516 $ 68,790 $ 66,090 $ 67,680 $ (1,110)

Capital Improvements 1,584,234 1,583,944 1,583,944 1,581,419 (2,525)

Non-Departmental 715,000 1,656,987 1,515,000 1,987,500 330,513

TOTAL $ 2,542,750 $ 3,309,721 $ 3,165,034 $ 3,636,599 $ 326,878

EXPENDITURES BY CATEGORY:

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance 16,071 25,000 23,500 25,000 –

Services & other 46,836 43,790 42,590 42,680 (1,110)

Debt service 1,584,234 1,583,944 1,583,944 1,581,419 (2,525)

Transfers to other funds 715,000 1,656,987 1,515,000 1,987,500 330,513

Capital outlay 180,610 – – – –

TOTAL $ 2,542,750 $ 3,309,721 $ 3,165,034 $ 3,636,599 $ 326,878

277