Page 59 - FortWorthFY22AdoptedBudget

P. 59

Budget Highlights

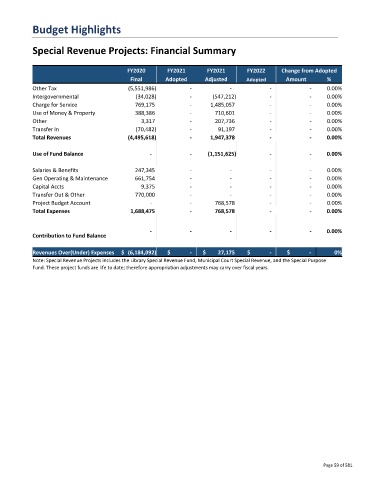

Special Revenue Projects: Financial Summary

FY2020 FY2021 FY2021 FY2022 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Other Tax (5,551,986) - - - - 0.00%

Intergovernmental (34,028) - (547,212) - - 0.00%

Charge for Service 769,175 - 1,485,057 - - 0.00%

Use of Money & Property 388,386 - 710,601 - - 0.00%

Other 3,317 - 207,736 - - 0.00%

Transfer In (70,482) - 91,197 - - 0.00%

Total Revenues (4,495,618) - 1,947,378 - - 0.00%

Use of Fund Balance - - (1,151,625) - - 0.00%

Salaries & Benefits 247,345 - - - - 0.00%

Gen Operating & Maintenance 661,754 - - - - 0.00%

Capital Accts 9,375 - - - - 0.00%

Transfer Out & Other 770,000 - - - - 0.00%

Project Budget Account - - 768,578 - - 0.00%

Total Expenses 1,688,475 - 768,578 - - 0.00%

- - - - - 0.00%

Contribution to Fund Balance

Revenues Over(Under) Expenses $ (6,184,092) $ - $ 27,175 $ - $ - 0%

Note: Special Revenue Projects includes the Library Special Revenue Fund, Municipal Court Special Revenue, and the Special Purpose

Fund. These project funds are life to date; therefore appropriation adjustments may carry over fiscal years.

Page 59 of 581