Page 58 - FortWorthFY22AdoptedBudget

P. 58

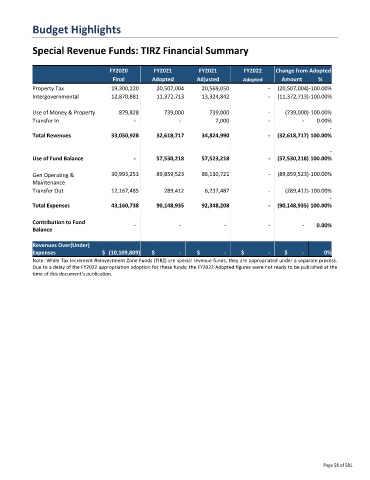

Budget Highlights

Special Revenue Funds: TIRZ Financial Summary

FY2020 FY2021 FY2021 FY2022 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 19,300,220 20,507,004 20,569,050 - (20,507,004)-100.00%

Intergovernmental 12,870,881 11,372,713 13,324,842 - (11,372,713)-100.00%

Use of Money & Property 879,828 739,000 739,000 - (739,000)-100.00%

Transfer In - - 7,000 - - 0.00%

-

Total Revenues 33,050,928 32,618,717 34,824,990 - (32,618,717) 100.00%

-

Use of Fund Balance - 57,530,218 57,523,218 - (57,530,218) 100.00%

Gen Operating & 30,993,253 89,859,523 86,110,721 - (89,859,523)-100.00%

Maintenance

Transfer Out 12,167,485 289,412 6,237,487 - (289,412)-100.00%

-

Total Expenses 43,160,738 90,148,935 92,348,208 - (90,148,935) 100.00%

Contribution to Fund - - - - - 0.00%

Balance

Revenues Over(Under)

Expenses $ (10,109,809) $ - $ - $ - $ - 0%

Note: While Tax Increment Reinvestment Zone Funds (TIRZ) are special revenue funds, they are appropriated under a separate process.

Due to a delay of the FY2022 appropriation adoption for these funds; the FY2022 Adopted figures were not ready to be published at the

time of this document’s publication.

Page 58 of 581