Page 124 - Watauga FY21 Budget

P. 124

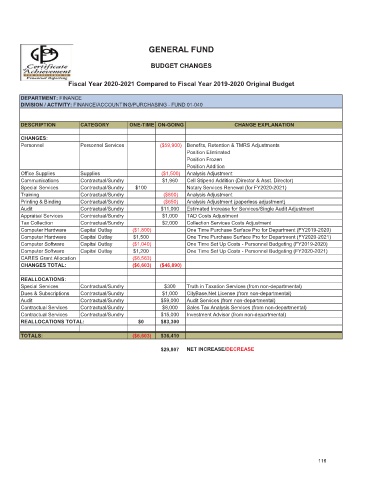

GENERAL FUND

BUDGET CHANGES

Fiscal Year 2020-2021 Compared to Fiscal Year 2019-2020 Original Budget

DEPARTMENT: FINANCE

DIVISION / ACTIVITY: FINANCE/ACCOUNTING/PURCHASING - FUND 01-040

DESCRIPTION CATEGORY ONE-TIME ON-GOING CHANGE EXPLANATION

CHANGES:

Personnel Personnel Services ($59,900) Benefits, Retention & TMRS Adjustments

Position Eliminated

Position Frozen

Position Addition

Office Supplies Supplies ($1,500) Analysis Adjustment

Communications Contractual/Sundry $1,960 Cell Stipend Addition (Director & Asst. Director)

Special Services Contractual/Sundry $100 Notary Services Renewal (for FY2020-2021)

Training Contractual/Sundry ($800) Analysis Adjustment

Printing & Binding Contractual/Sundry ($650) Analysis Adjustment (paperless adjustment)

Audit Contractual/Sundry $11,000 Estimated Increase for Services/Single Audit Adjustment

Appraisal Services Contractual/Sundry $1,000 TAD Costs Adjustment

Tax Collection Contractual/Sundry $2,000 Collection Services Costs Adjustment

Computer Hardware Capital Outlay ($1,800) One Time Purchase Surface Pro for Department (FY2019-2020)

Computer Hardware Capital Outlay $1,500 One Time Purchase Surface Pro for Department (FY2020-2021)

Computer Software Capital Outlay ($1,040) One Time Set Up Costs - Personnel Budgeting (FY2019-2020)

Computer Software Capital Outlay $1,200 One Time Set Up Costs - Personnel Budgeting (FY2020-2021)

CARES Grant Allocation ($6,563)

CHANGES TOTAL: ($6,603) ($46,890)

REALLOCATIONS:

Special Services Contractual/Sundry $300 Truth in Taxation Services (from non-departmental)

Dues & Subscriptions Contractual/Sundry $1,000 CityBase.Net License (from non-departmental)

Audit Contractual/Sundry $59,000 Audit Services (from non-departmental)

Contractual Services Contractual/Sundry $8,000 Sales Tax Analysis Services (from non-departmental)

Contractual Services Contractual/Sundry $15,000 Investment Advisor (from non-departmental)

REALLOCATIONS TOTAL: $0 $83,300

TOTALS: ($6,603) $36,410

$29,807 NET INCREASE/DECREASE

116