Page 74 - Keller Budget FY21

P. 74

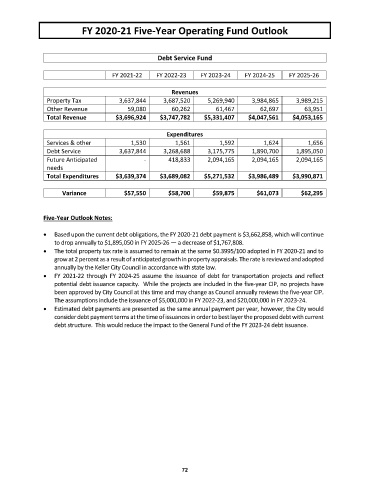

FY 2020‐21 Five‐Year Operating Fund Outlook

Debt Service Fund

FY 2021‐22 FY 2022‐23 FY 2023‐24 FY 2024‐25 FY 2025‐26

Revenues

Property Tax 3,637,844 3,687,520 5,269,940 3,984,865 3,989,215

Other Revenue 59,080 60,262 61,467 62,697 63,951

Total Revenue $3,696,924 $3,747,782 $5,331,407 $4,047,561 $4,053,165

Expenditures

Services & other 1,530 1,561 1,592 1,624 1,656

Debt Service 3,637,844 3,268,688 3,175,775 1,890,700 1,895,050

Future Anticipated ‐ 418,833 2,094,165 2,094,165 2,094,165

needs

Total Expenditures $3,639,374 $3,689,082 $5,271,532 $3,986,489 $3,990,871

Variance $57,550 $58,700 $59,875 $61,073 $62,295

Five‐Year Outlook Notes:

Based upon the current debt obligations, the FY 2020‐21 debt payment is $3,662,858, which will continue

to drop annually to $1,895,050 in FY 2025‐26 — a decrease of $1,767,808.

The total property tax rate is assumed to remain at the same $0.3995/100 adopted in FY 2020‐21 and to

grow at 2 percent as a result of anticipated growth in property appraisals. The rate is reviewed and adopted

annually by the Keller City Council in accordance with state law.

FY 2021‐22 through FY 2024‐25 assume the issuance of debt for transportation projects and reflect

potential debt issuance capacity. While the projects are included in the five‐year CIP, no projects have

been approved by City Council at this time and may change as Council annually reviews the five‐year CIP.

The assumptions include the issuance of $5,000,000 in FY 2022‐23, and $20,000,000 in FY 2023‐24.

Estimated debt payments are presented as the same annual payment per year, however, the City would

consider debt payment terms at the time of issuances in order to best layer the proposed debt with current

debt structure. This would reduce the impact to the General Fund of the FY 2023‐24 debt issuance.

72