Page 73 - Keller Budget FY21

P. 73

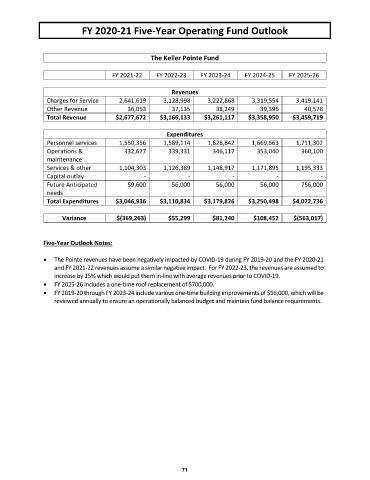

FY 2020‐21 Five‐Year Operating Fund Outlook

The Keller Pointe Fund

FY 2021‐22 FY 2022‐23 FY 2023‐24 FY 2024‐25 FY 2025‐26

Revenues

Charges for Service 2,641,619 3,128,998 3,222,868 3,319,554 3,419,141

Other Revenue 36,053 37,135 38,249 39,396 40,578

Total Revenue $2,677,672 $3,166,133 $3,261,117 $3,358,950 $3,459,719

Expenditures

Personnel services 1,550,356 1,589,114 1,628,842 1,669,563 1,711,302

Operations & 332,677 339,331 346,117 353,040 360,100

maintenance

Services & other 1,104,303 1,126,389 1,148,917 1,171,895 1,195,333

Capital outlay ‐ ‐ ‐ ‐ ‐

Future Anticipated 59,600 56,000 56,000 56,000 756,000

needs

Total Expenditures $3,046,936 $3,110,834 $3,179,876 $3,250,498 $4,022,736

Variance $(369,263) $55,299 $81,240 $108,452 $(563,017)

Five‐Year Outlook Notes:

The Pointe revenues have been negatively impacted by COVID‐19 during FY 2019‐20 and the FY 2020‐21

and FY 2021‐22 revenues assume a similar negative impact. For FY 2022‐23, the revenues are assumed to

increase by 15% which would put them in‐line with average revenues prior to COVID‐19.

FY 2025‐26 includes a one‐time roof replacement of $700,000.

FY 2019‐20 through FY 2023‐24 include various one‐time building improvements of $56,000, which will be

reviewed annually to ensure an operationally balanced budget and maintain fund balance requirements.

71