Page 69 - Keller Budget FY21

P. 69

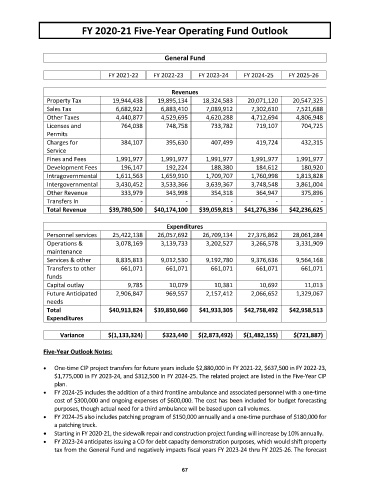

FY 2020‐21 Five‐Year Operating Fund Outlook

General Fund

FY 2021‐22 FY 2022‐23 FY 2023‐24 FY 2024‐25 FY 2025‐26

Revenues

Property Tax 19,944,438 19,895,134 18,324,583 20,071,120 20,547,325

Sales Tax 6,682,922 6,883,410 7,089,912 7,302,610 7,521,688

Other Taxes 4,440,877 4,529,695 4,620,288 4,712,694 4,806,948

Licenses and 764,038 748,758 733,782 719,107 704,725

Permits

Charges for 384,107 395,630 407,499 419,724 432,315

Service

Fines and Fees 1,991,977 1,991,977 1,991,977 1,991,977 1,991,977

Development Fees 196,147 192,224 188,380 184,612 180,920

Intragovernmental 1,611,563 1,659,910 1,709,707 1,760,998 1,813,828

Intergovernmental 3,430,452 3,533,366 3,639,367 3,748,548 3,861,004

Other Revenue 333,979 343,998 354,318 364,947 375,896

Transfers In ‐ ‐ ‐ ‐ ‐

Total Revenue $39,780,500 $40,174,100 $39,059,813 $41,276,336 $42,236,625

Expenditures

Personnel services 25,422,138 26,057,692 26,709,134 27,376,862 28,061,284

Operations & 3,078,169 3,139,733 3,202,527 3,266,578 3,331,909

maintenance

Services & other 8,835,813 9,012,530 9,192,780 9,376,636 9,564,168

Transfers to other 661,071 661,071 661,071 661,071 661,071

funds

Capital outlay 9,785 10,079 10,381 10,692 11,013

Future Anticipated 2,906,847 969,557 2,157,412 2,066,652 1,329,067

needs

Total $40,913,824 $39,850,660 $41,933,305 $42,758,492 $42,958,513

Expenditures

Variance $(1,133,324) $323,440 $(2,873,492) $(1,482,155) $(721,887)

Five‐Year Outlook Notes:

One‐time CIP project transfers for future years include $2,880,000 in FY 2021‐22, $637,500 in FY 2022‐23,

$1,775,000 in FY 2023‐24, and $312,500 In FY 2024‐25. The related project are listed in the Five‐Year CIP

plan.

FY 2024‐25 includes the addition of a third frontline ambulance and associated personnel with a one‐time

cost of $300,000 and ongoing expenses of $600,000. The cost has been included for budget forecasting

purposes, though actual need for a third ambulance will be based upon call volumes.

FY 2024‐25 also includes patching program of $150,000 annually and a one‐time purchase of $180,000 for

a patching truck.

Starting in FY 2020‐21, the sidewalk repair and construction project funding will increase by 10% annually.

FY 2023‐24 anticipates issuing a CO for debt capacity demonstration purposes, which would shift property

tax from the General Fund and negatively impacts fiscal years FY 2023‐24 thru FY 2025‐26. The forecast

67