Page 64 - Keller Budget FY21

P. 64

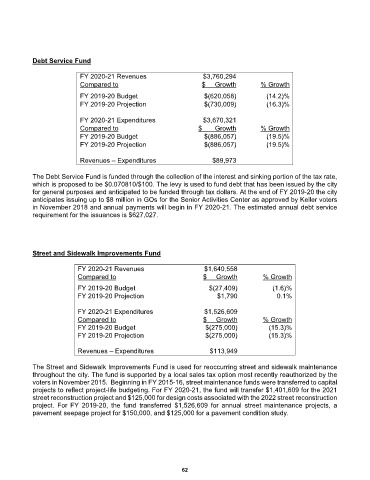

Debt Service Fund

FY 2020-21 Revenues $3,760,294

Compared to $ Growth % Growth

FY 2019-20 Budget $(620,058) (14.2)%

FY 2019-20 Projection $(730,009) (16.3)%

FY 2020-21 Expenditures $3,670,321

Compared to $ Growth % Growth

FY 2019-20 Budget $(886,057) (19.5)%

FY 2019-20 Projection $(886,057) (19.5)%

Revenues – Expenditures $89,973

The Debt Service Fund is funded through the collection of the interest and sinking portion of the tax rate,

which is proposed to be $0.070810/$100. The levy is used to fund debt that has been issued by the city

for general purposes and anticipated to be funded through tax dollars. At the end of FY 2019-20 the city

anticipates issuing up to $8 million in GOs for the Senior Activities Center as approved by Keller voters

in November 2018 and annual payments will begin in FY 2020-21. The estimated annual debt service

requirement for the issuances is $627,027.

Street and Sidewalk Improvements Fund

FY 2020-21 Revenues $1,640,558

Compared to $ Growth % Growth

FY 2019-20 Budget $(27,409) (1.6)%

FY 2019-20 Projection $1,790 0.1%

FY 2020-21 Expenditures $1,526,609

Compared to $ Growth % Growth

FY 2019-20 Budget $(275,000) (15.3)%

FY 2019-20 Projection $(275,000) (15.3)%

Revenues – Expenditures $113,949

The Street and Sidewalk Improvements Fund is used for reoccurring street and sidewalk maintenance

throughout the city. The fund is supported by a local sales tax option most recently reauthorized by the

voters in November 2015. Beginning in FY 2015-16, street maintenance funds were transferred to capital

projects to reflect project-life budgeting. For FY 2020-21, the fund will transfer $1,401,609 for the 2021

street reconstruction project and $125,000 for design costs associated with the 2022 street reconstruction

project. For FY 2019-20, the fund transferred $1,526,609 for annual street maintenance projects, a

pavement seepage project for $150,000, and $125,000 for a pavement condition study.

62