Page 287 - Hurst Budget FY21

P. 287

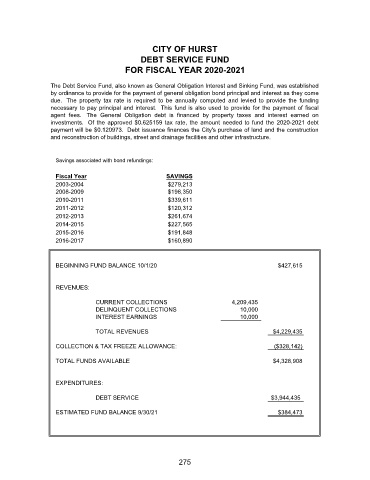

CITY OF HURST

DEBT SERVICE FUND

FOR FISCAL YEAR 2020-2021

The Debt Service Fund, also known as General Obligation Interest and Sinking Fund, was established

by ordinance to provide for the payment of general obligation bond principal and interest as they come

due. The property tax rate is required to be annually computed and levied to provide the funding

necessary to pay principal and interest. This fund is also used to provide for the payment of fiscal

agent fees. The General Obligation debt is financed by property taxes and interest earned on

investments. Of the approved $0.625159 tax rate, the amount needed to fund the 2020-2021 debt

payment will be $0.120973. Debt issuance finances the City's purchase of land and the construction

and reconstruction of buildings, street and drainage facilities and other infrastructure.

Savings associated with bond refundings:

Fiscal Year SAVINGS

2003-2004 $279,213

2008-2009 $198,350

2010-2011 $339,611

2011-2012 $120,312

2012-2013 $261,674

2014-2015 $227,565

2015-2016 $191,848

2016-2017 $160,890

BEGINNING FUND BALANCE 10/1/20 $427,615

REVENUES:

CURRENT COLLECTIONS 4,209,435

DELINQUENT COLLECTIONS 10,000

INTEREST EARNINGS 10,000

TOTAL REVENUES $4,229,435

COLLECTION & TAX FREEZE ALLOWANCE: ($328,142)

TOTAL FUNDS AVAILABLE $4,328,908

EXPENDITURES:

DEBT SERVICE $3,944,435

ESTIMATED FUND BALANCE 9/30/21 $384,473

275