Page 290 - Hurst Budget FY21

P. 290

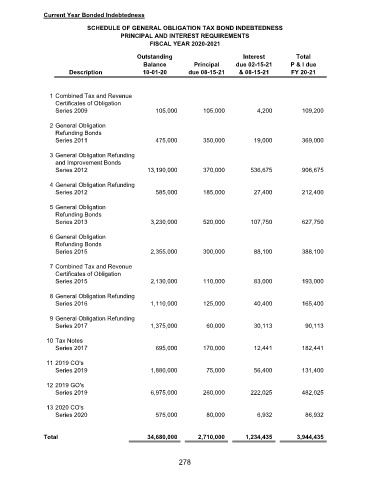

Current Year Bonded Indebtedness

SCHEDULE OF GENERAL OBLIGATION TAX BOND INDEBTEDNESS

PRINCIPAL AND INTEREST REQUIREMENTS

FISCAL YEAR 2020-2021

Outstanding Interest Total

Balance Principal due 02-15-21 P & I due

Description 10-01-20 due 08-15-21 & 08-15-21 FY 20-21

1 Combined Tax and Revenue

Certificates of Obligation

Series 2009 105,000 105,000 4,200 109,200

2 General Obligation

Refunding Bonds

Series 2011 475,000 350,000 19,000 369,000

3 General Obligation Refunding

and Improvement Bonds

Series 2012 13,190,000 370,000 536,675 906,675

4 General Obligation Refunding

Series 2012 585,000 185,000 27,400 212,400

5 General Obligation

Refunding Bonds

Series 2013 3,230,000 520,000 107,750 627,750

6 General Obligation

Refunding Bonds

Series 2015 2,355,000 300,000 88,100 388,100

7 Combined Tax and Revenue

Certificates of Obligation

Series 2015 2,130,000 110,000 83,000 193,000

8 General Obligation Refunding

Series 2016 1,110,000 125,000 40,400 165,400

9 General Obligation Refunding

Series 2017 1,375,000 60,000 30,113 90,113

10 Tax Notes

Series 2017 695,000 170,000 12,441 182,441

11 2019 CO's

Series 2019 1,880,000 75,000 56,400 131,400

12 2019 GO's

Series 2019 6,975,000 260,000 222,025 482,025

13 2020 CO's

Series 2020 575,000 80,000 6,932 86,932

Total 34,680,000 2,710,000 1,234,435 3,944,435

278