Page 67 - Grapevine Budget FY21

P. 67

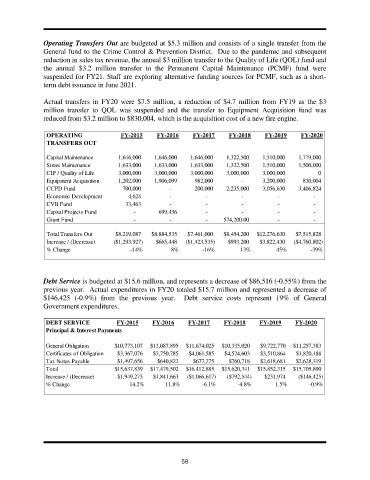

Operating Transfers Out are budgeted at $5.3 million and consists of a single transfer from the

General fund to the Crime Control & Prevention District. Due to the pandemic and subsequent

reduction in sales tax revenue, the annual $3 million transfer to the Quality of Life (QOL) fund and

the annual $3.2 million transfer to the Permanent Capital Maintenance (PCMF) fund were

suspended for FY21. Staff are exploring alternative funding sources for PCMF, such as a short-

term debt issuance in June 2021.

Actual transfers in FY20 were $7.5 million, a reduction of $4.7 million from FY19 as the $3

million transfer to QOL was suspended and the transfer to Equipment Acquisition fund was

reduced from $3.2 million to $830,004, which is the acquisition cost of a new fire engine.

OPERATING FY-2015 FY-2016 FY-2017 FY-2018 FY-2019 FY-2020

TRANSFERS OUT

Capital Maintenance 1,646,000 1,646,000 1,646,000 1,322,500 1,510,000 1,779,000

Street Maintenance 1,633,000 1,633,000 1,633,000 1,322,500 1,510,000 1,500,000

CIP / Quality of Life 3,000,000 3,000,000 3,000,000 3,000,000 3,000,000 0

Equipment Acquisition 1,202,000 1,906,099 982,000 - 3,200,000 830,004

CCPD Fund 700,000 - 200,000 2,235,000 3,056,630 3,406,824

Economic Development 4,624 - - - - -

CVB Fund 33,463 - - - - -

Capital Projects Fund - 699,436 - - - -

Grant Fund - - - 574,200.00 - -

Total Transfers Out $8,219,087 $8,884,535 $7,461,000 $8,454,200 $12,276,630 $7,515,828

Increase / (Decrease) ($1,293,927) $665,448 ($1,423,535) $993,200 $3,822,430 ($4,760,802)

% Change -14% 8% -16% 13% 45% -39%

Debt Service is budgeted at $15.6 million, and represents a decrease of $86,516 (-0.55%) from the

previous year. Actual expenditures in FY20 totaled $15.7 million and represented a decrease of

$146,425 (-0.9%) from the previous year. Debt service costs represent 19% of General

Government expenditures.

DEBT SERVICE FY-2015 FY-2016 FY-2017 FY-2018 FY-2019 FY-2020

Principal & Interest Payments

General Obligation $10,773,107 $13,087,895 $11,674,025 $10,335,020 $9,722,770 $11,257,383

Certificates of Obligation $3,367,076 $3,750,785 $4,061,585 $4,524,603 $3,510,864 $1,820,188

Tax Notes Payable $1,497,656 $640,822 $677,275 $760,718 $2,618,681 $2,628,319

Total $15,637,839 $17,479,502 $16,412,885 $15,620,341 $15,852,315 $15,705,890

Increase / (Decrease) $1,949,273 $1,841,663 ($1,066,617) ($792,544) $231,974 ($146,425)

% Change 14.2% 11.8% -6.1% -4.8% 1.5% -0.9%

59