Page 66 - Grapevine Budget FY21

P. 66

Services are budgeted at $11.5 million and represent a $700,000 decrease (5.7%) from the FY20

budget. Professional services, defined as services that by their nature can be performed by

persons or firms with specialized skills and knowledge who are non-City employees, represents

the largest segment of the category, at $4.8 million for FY21. Utility costs

(electricity/gas/water/telephone) represent the second-largest segment at $2.9 million, and

represent an increase of $170,000 over the previous year. Actual expenditures in FY20 are

estimated to total $13 million, and represent an increase of 1.1% from FY19. Expenditures for

services account for 14% of General Government expenditures.

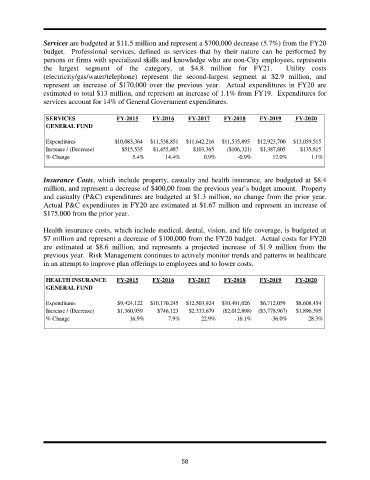

SERVICES FY-2015 FY-2016 FY-2017 FY-2018 FY-2019 FY-2020

GENERAL FUND

Expenditures $10,083,364 $11,538,851 $11,642,216 $11,535,895 $12,923,700 $13,059,515

Increase / (Decrease) $515,535 $1,455,487 $103,365 ($106,321) $1,387,805 $135,815

% Change 5.4% 14.4% 0.9% -0.9% 12.0% 1.1%

Insurance Costs, which include property, casualty and health insurance, are budgeted at $8.4

million, and represent a decrease of $400,00 from the previous year’s budget amount. Property

and casualty (P&C) expenditures are budgeted at $1.3 million, no change from the prior year.

Actual P&C expenditures in FY20 are estimated at $1.67 million and represent an increase of

$175,000 from the prior year.

Health insurance costs, which include medical, dental, vision, and life coverage, is budgeted at

$7 million and represent a decrease of $100,000 from the FY20 budget. Actual costs for FY20

are estimated at $8.6 million, and represents a projected increase of $1.9 million from the

previous year. Risk Management continues to actively monitor trends and patterns in healthcare

in an attempt to improve plan offerings to employees and to lower costs.

HEALTH INSURANCE FY-2015 FY-2016 FY-2017 FY-2018 FY-2019 FY-2020

GENERAL FUND

Expenditures $9,424,122 $10,170,245 $12,503,924 $10,491,026 $6,712,059 $8,608,454

Increase / (Decrease) $1,360,959 $746,123 $2,333,679 ($2,012,898) ($3,778,967) $1,896,395

% Change 16.9% 7.9% 22.9% -16.1% -36.0% 28.3%

58