Page 34 - City of Westlake FY20 Budget

P. 34

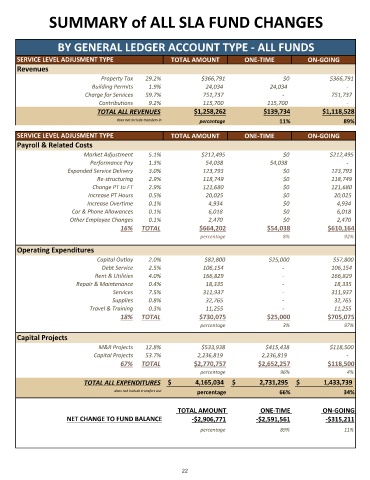

SUMMARY of ALL SLA FUND CHANGES

BY GENERAL LEDGER ACCOUNT TYPE ‐ ALL FUNDS

SERVICE LEVEL ADJUSMENT TYPE TOTAL AMOUNT ONE‐TIME ON‐GOING

Revenues

Property Tax 29.2% $366,791 $0 $366,791

Building Permits 1.9% 24,034 24,034 ‐

Charge for Services 59.7% 751,737 ‐ 751,737

Contributions 9.2% 115,700 115,700 ‐

TOTAL ALL REVENUES $1,258,262 $139,734 $1,118,528

does not include transfers in percentage 11% 89%

SERVICE LEVEL ADJUSMENT TYPE TOTAL AMOUNT ONE‐TIME ON‐GOING

Payroll & Related Costs

Market Adjustment 5.1% $212,495 $0 $212,495

Performance Pay 1.3% 54,038 54,038 ‐

Expanded Service Delivery 3.0% 123,793 $0 123,793

Re‐structuring 2.9% 118,749 $0 118,749

Change PT to FT 2.9% 121,680 $0 121,680

Increase PT Hours 0.5% 20,025 $0 20,025

Increase Overtime 0.1% 4,934 $0 4,934

Car & Phone Allowances 0.1% 6,018 $0 6,018

Other Employee Changes 0.1% 2,470 $0 2,470

16% TOTAL $664,202 $54,038 $610,164

percentage 8% 92%

Operating Expenditures

Capital Outlay 2.0% $82,800 $25,000 $57,800

Debt Service 2.5% 106,154 ‐ 106,154

Rent & Utilities 4.0% 166,829 ‐ 166,829

Repair & Maintenance 0.4% 18,335 ‐ 18,335

Services 7.5% 311,937 ‐ 311,937

Supplies 0.8% 32,765 ‐ 32,765

Travel & Training 0.3% 11,255 ‐ 11,255

18% TOTAL $730,075 $25,000 $705,075

percentage 3% 97%

Capital Projects

M&R Projects 12.8% $533,938 $415,438 $118,500

Capital Projects 53.7% 2,236,819 2,236,819 ‐

67% TOTAL $2,770,757 $2,652,257 $118,500

percentage 96% 4%

TOTAL ALL EXPENDITURES $ 4,165,034 $ 2,731,295 $ 1,433,739

does not include transfers out percentage 66% 34%

TOTAL AMOUNT ONE‐TIME ON‐GOING

NET CHANGE TO FUND BALANCE ‐$2,906,771 ‐$2,591,561 ‐$315,211

percentage 89% 11%

22