Page 199 - NRH FY20 Approved Budget

P. 199

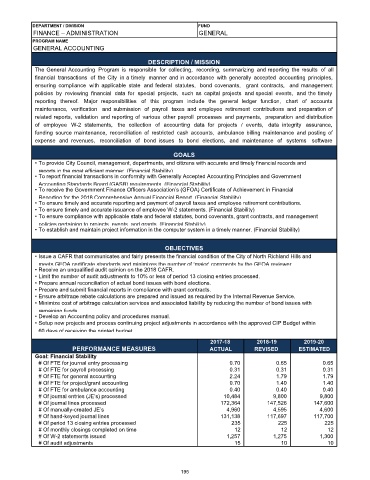

DEPARTMENT / DIVISION FUND

FINANCE – ADMINISTRATION GENERAL

PROGRAM NAME

GENERAL ACCOUNTING

DESCRIPTION / MISSION

The General Accounting Program is responsible for collecting, recording, summarizing and reporting the results of all

financial transactions of the City in a timely manner and in accordance with generally accepted accounting principles,

ensuring compliance with applicable state and federal statutes, bond covenants, grant contracts, and management

policies by reviewing financial data for special projects, such as capital projects and special events, and the timely

reporting thereof. Major responsibilities of this program include the general ledger function, chart of accounts

maintenance, verification and submission of payroll taxes and employee retirement contributions and preparation of

related reports, validation and reporting of various other payroll processes and payments, preparation and distribution

of employee W-2 statements, the collection of accounting data for projects / events, data integrity assurance,

funding source maintenance, reconciliation of restricted cash accounts, ambulance billing maintenance and posting of

expense and revenues, reconciliation of bond issues to bond elections, and maintenance of systems software

GOALS

• To provide City Council, management, departments, and citizens with accurate and timely financial records and

reports in the most efficient manner (Financial Stability)

• To report financial transactions in conformity with Generally Accepted Accounting Principles and Government

Accounting Standards Board (GASB) requirements (Financial Stability)

• To receive the Government Finance Officers Association’s (GFOA) Certificate of Achievement in Financial

Reporting for the 2018 Comprehensive Annual Financial Report (Financial Stability)

• To ensure timely and accurate reporting and payment of payroll taxes and employee retirement contributions.

• To ensure timely and accurate issuance of employee W-2 statements. (Financial Stability)

• To ensure compliance with applicable state and federal statutes, bond covenants, grant contracts, and management

policies pertaining to projects events and grants (Financial Stability)

• To establish and maintain project information in the computer system in a timely manner. (Financial Stability)

OBJECTIVES

• Issue a CAFR that communicates and fairly presents the financial condition of the City of North Richland Hills and

meets GFOA certificate standards and minimizes the number of ‘major’ comments by the GFOA reviewer

• Receive an unqualified audit opinion on the 2018 CAFR.

• Limit the number of audit adjustments to 10% or less of period 13 closing entries processed.

• Prepare annual reconciliation of actual bond issues with bond elections.

• Prepare and submit financial reports in compliance with grant contracts.

• Ensure arbitrage rebate calculations are prepared and issued as required by the Internal Revenue Service.

• Minimize cost of arbitrage calculation services and associated liability by reducing the number of bond issues with

remaining funds

• Develop an Accounting policy and procedures manual.

• Setup new projects and process continuing project adjustments in accordance with the approved CIP Budget within

60 days of receiving the printed budget

2017-18 2018-19 2019-20

PERFORMANCE MEASURES ACTUAL REVISED ESTIMATED

Goal: Financial Stability

# Of FTE for journal entry processing 0.70 0.65 0.65

# Of FTE for payroll processing 0.31 0.31 0.31

# Of FTE for general accounting 2.24 1.79 1.79

# Of FTE for project/grant accounting 0.70 1.40 1.40

# Of FTE for ambulance accounting 0.40 0.40 0.40

# Of journal entries (JE’s) processed 10,484 9,800 9,800

# Of journal lines processed 172,364 147,526 147,600

# Of manually-created JE’s 4,960 4,595 4,600

# Of hand-keyed journal lines 131,138 117,697 117,700

# Of period 13 closing entries processed 235 225 225

# Of monthly closings completed on time 12 12 12

# Of W-2 statements issued 1,257 1,275 1,300

# Of audit adjustments 15 10 10

195