Page 201 - NRH FY20 Approved Budget

P. 201

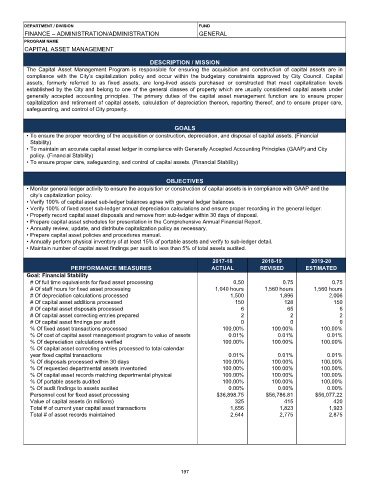

DEPARTMENT / DIVISION FUND

FINANCE – ADMINISTRATION/ADMINISTRATION GENERAL

PROGRAM NAME

CAPITAL ASSET MANAGEMENT

DESCRIPTION / MISSION

The Capital Asset Management Program is responsible for ensuring the acquisition and construction of capital assets are in

compliance with the City’s capitalization policy and occur within the budgetary constraints approved by City Council. Capital

assets, formerly referred to as fixed assets, are long-lived assets purchased or constructed that meet capitalization levels

established by the City and belong to one of the general classes of property which are usually considered capital assets under

generally accepted accounting principles. The primary duties of the capital asset management function are to ensure proper

capitalization and retirement of capital assets, calculation of depreciation thereon, reporting thereof, and to ensure proper care,

safeguarding, and control of City property.

GOALS

• To ensure the proper recording of the acquisition or construction, depreciation, and disposal of capital assets. (Financial

Stability)

• To maintain an accurate capital asset ledger in compliance with Generally Accepted Accounting Principles (GAAP) and City

policy. (Financial Stability)

• To ensure proper care, safeguarding, and control of capital assets. (Financial Stability)

OBJECTIVES

• Monitor general ledger activity to ensure the acquisition or construction of capital assets is in compliance with GAAP and the

city’s capitalization policy.

• Verify 100% of capital asset sub-ledger balances agree with general ledger balances.

• Verify 100% of fixed asset sub-ledger annual depreciation calculations and ensure proper recording in the general ledger.

• Properly record capital asset disposals and remove from sub-ledger within 30 days of disposal.

• Prepare capital asset schedules for presentation in the Comprehensive Annual Financial Report.

• Annually review, update, and distribute capitalization policy as necessary.

• Prepare capital asset policies and procedures manual.

• Annually perform physical inventory of at least 15% of portable assets and verify to sub-ledger detail.

• Maintain number of capital asset findings per audit to less than 5% of total assets audited.

2017-18 2018-19 2019-20

PERFORMANCE MEASURES ACTUAL REVISED ESTIMATED

Goal: Financial Stability

# Of full time equivalents for fixed asset processing 0.50 0.75 0.75

# Of staff hours for fixed asset processing 1,040 hours 1,560 hours 1,560 hours

# Of depreciation calculations processed 1,500 1,896 2,006

# Of capital asset additions processed 150 128 150

# Of capital asset disposals processed 6 65 6

# Of capital asset correcting entries prepared 2 2 2

# Of capital asset findings per audit 0 0 0

% Of fixed asset transactions processed 100.00% 100.00% 100.00%

% Of cost of capital asset management program to value of assets 0.01% 0.01% 0.01%

% Of depreciation calculations verified 100.00% 100.00% 100.00%

% Of capital asset correcting entries processed to total calendar

year fixed capital transactions 0.01% 0.01% 0.01%

% Of disposals processed within 30 days 100.00% 100.00% 100.00%

% Of requested departmental assets inventoried 100.00% 100.00% 100.00%

% Of capital asset records matching departmental physical 100.00% 100.00% 100.00%

% Of portable assets audited 100.00% 100.00% 100.00%

% Of audit findings to assets audited 0.00% 0.00% 0.00%

Personnel cost for fixed asset processing $36,898.75 $56,786.81 $56,077.22

Value of capital assets (in millions) 325 415 420

Total # of current year capital asset transactions 1,656 1,823 1,923

Total # of asset records maintained 2,644 2,775 2,875

197