Page 204 - NRH FY20 Approved Budget

P. 204

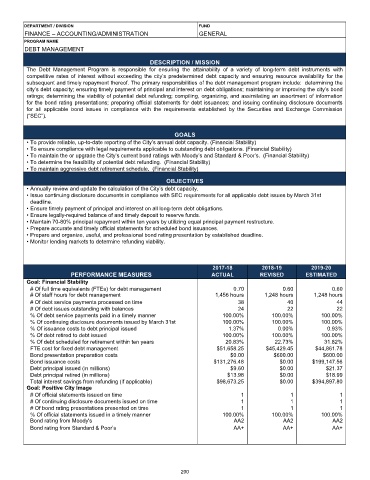

DEPARTMENT / DIVISION FUND

FINANCE – ACCOUNTING/ADMINISTRATION GENERAL

PROGRAM NAME

DEBT MANAGEMENT

DESCRIPTION / MISSION

The Debt Management Program is responsible for ensuring the attainability of a variety of long-term debt instruments with

competitive rates of interest without exceeding the city’s predetermined debt capacity and ensuring resource availability for the

subsequent and timely repayment thereof. The primary responsibilities of the debt management program include: determining the

city’s debt capacity; ensuring timely payment of principal and interest on debt obligations; maintaining or improving the city’s bond

ratings; determining the viability of potential debt refunding; compiling, organizing, and assimilating an assortment of information

for the bond rating presentations; preparing official statements for debt issuances; and issuing continuing disclosure documents

for all applicable bond issues in compliance with the requirements established by the Securities and Exchange Commission

(“SEC”).

GOALS

• To provide reliable, up-to-date reporting of the City’s annual debt capacity. (Financial Stability)

• To ensure compliance with legal requirements applicable to outstanding debt obligations. (Financial Stability)

• To maintain the or upgrade the City’s current bond ratings with Moody’s and Standard & Poor’s. (Financial Stability)

• To determine the feasibility of potential debt refunding. (Financial Stability)

• To maintain aggressive debt retirement schedule. (Financial Stability)

OBJECTIVES

• Annually review and update the calculation of the City’s debt capacity.

• Issue continuing disclosure documents in compliance with SEC requirements for all applicable debt issues by March 31st

deadline.

• Ensure timely payment of principal and interest on all long-term debt obligations.

• Ensure legally-required balance of and timely deposit to reserve funds.

• Maintain 70-80% principal repayment within ten years by utilizing equal principal payment restructure.

• Prepare accurate and timely official statements for scheduled bond issuances.

• Prepare and organize, useful, and professional bond rating presentation by established deadline.

• Monitor lending markets to determine refunding viability.

2017-18 2018-19 2019-20

PERFORMANCE MEASURES ACTUAL REVISED ESTIMATED

Goal: Financial Stability

# Of full time equivalents (FTEs) for debt management 0.70 0.60 0.60

# Of staff hours for debt management 1,456 hours 1,248 hours 1,248 hours

# Of debt service payments processed on time 38 40 44

# Of debt issues outstanding with balances 24 22 22

% Of debt service payments paid in a timely manner 100.00% 100.00% 100.00%

% Of continuing disclosure documents issued by March 31st 100.00% 100.00% 100.00%

% Of issuance costs to debt principal issued 1.37% 0.00% 0.93%

% Of debt retired to debt issued 100.00% 100.00% 100.00%

% Of debt scheduled for retirement within ten years 20.83% 22.73% 31.82%

FTE cost for fixed debt management $51,658.25 $45,429.45 $44,861.78

Bond presentation preparation costs $0.00 $600.00 $600.00

Bond issuance costs $131,276.48 $0.00 $199,147.56

Debt principal issued (in millions) $9.60 $0.00 $21.37

Debt principal retired (in millions) $13.98 $0.00 $18.99

Total interest savings from refunding (if applicable) $98,673.25 $0.00 $394,897.80

Goal: Positive City Image

# Of official statements issued on time 1 1 1

# Of continuing disclosure documents issued on time 1 1 1

# Of bond rating presentations presented on time 1 1 1

% Of official statements issued in a timely manner 100.00% 100.00% 100.00%

Bond rating from Moody's AA2 AA2 AA2

Bond rating from Standard & Poor’s AA+ AA+ AA+

200