Page 202 - NRH FY20 Approved Budget

P. 202

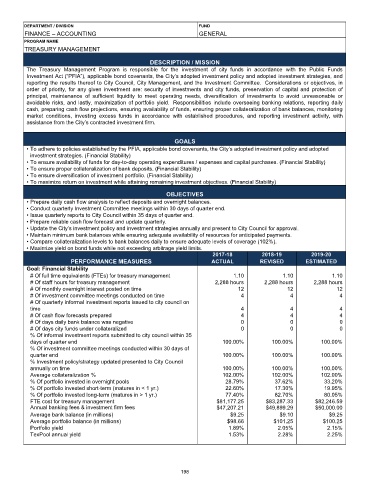

DEPARTMENT / DIVISION FUND

FINANCE – ACCOUNTING GENERAL

PROGRAM NAME

TREASURY MANAGEMENT

DESCRIPTION / MISSION

The Treasury Management Program is responsible for the investment of city funds in accordance with the Public Funds

Investment Act (“PFIA”), applicable bond covenants, the City’s adopted investment policy and adopted investment strategies, and

reporting the results thereof to City Council, City Management, and the Investment Committee. Considerations or objectives, in

order of priority, for any given investment are: security of investments and city funds, preservation of capital and protection of

principal, maintenance of sufficient liquidity to meet operating needs, diversification of investments to avoid unreasonable or

avoidable risks, and lastly, maximization of portfolio yield. Responsibilities include overseeing banking relations, reporting daily

cash, preparing cash flow projections, ensuring availability of funds, ensuring proper collateralization of bank balances, monitoring

market conditions, investing excess funds in accordance with established procedures, and reporting investment activity, with

assistance from the City’s contracted investment firm.

GOALS

• To adhere to policies established by the PFIA, applicable bond covenants, the City’s adopted investment policy and adopted

investment strategies. (Financial Stability)

• To ensure availability of funds for day-to-day operating expenditures / expenses and capital purchases. (Financial Stability)

• To ensure proper collateralization of bank deposits. (Financial Stability)

• To ensure diversification of investment portfolio. (Financial Stability)

• To maximize return on investment while attaining remaining investment objectives. (Financial Stability)

OBJECTIVES

• Prepare daily cash flow analysis to reflect deposits and overnight balances.

• Conduct quarterly Investment Committee meetings within 30 days of quarter end.

• Issue quarterly reports to City Council within 35 days of quarter end.

• Prepare reliable cash flow forecast and update quarterly.

• Update the City’s investment policy and investment strategies annually and present to City Council for approval.

• Maintain minimum bank balances while ensuring adequate availability of resources for anticipated payments.

• Compare collateralization levels to bank balances daily to ensure adequate levels of coverage (102%).

• Maximize yield on bond funds while not exceeding arbitrage yield limits.

2017-18 2018-19 2019-20

PERFORMANCE MEASURES ACTUAL REVISED ESTIMATED

Goal: Financial Stability

# Of full time equivalents (FTEs) for treasury management 1.10 1.10 1.10

# Of staff hours for treasury management 2,288 hours 2,288 hours 2,288 hours

# Of monthly overnight interest posted on time 12 12 12

# Of investment committee meetings conducted on time 4 4 4

# Of quarterly informal investment reports issued to city council on

time 4 4 4

# Of cash flow forecasts prepared 4 4 4

# Of days daily bank balance was negative 0 0 0

# Of days city funds under collateralized 0 0 0

% Of informal investment reports submitted to city council within 35

days of quarter end 100.00% 100.00% 100.00%

% Of investment committee meetings conducted within 30 days of

quarter end 100.00% 100.00% 100.00%

% Investment policy/strategy updated presented to City Council

annually on time 100.00% 100.00% 100.00%

Average collateralization % 102.00% 102.00% 102.00%

% Of portfolio invested in overnight pools 28.79% 37.62% 33.20%

% Of portfolio invested short-term (matures in < 1 yr.) 22.60% 17.30% 19.95%

% Of portfolio invested long-term (matures in > 1 yr.) 77.40% 82.70% 80.05%

FTE cost for treasury management $81,177.25 $83,287.33 $82,246.59

Annual banking fees & investment firm fees $47,207.21 $49,899.29 $50,000.00

Average bank balance (in millions) $9.25 $9.10 $9.25

Average portfolio balance (in millions) $98.66 $101.25 $100.25

Portfolio yield 1.89% 2.05% 2.15%

TexPool annual yield 1.53% 2.28% 2.25%

198