Page 332 - Hurst FY20 Approved Budget

P. 332

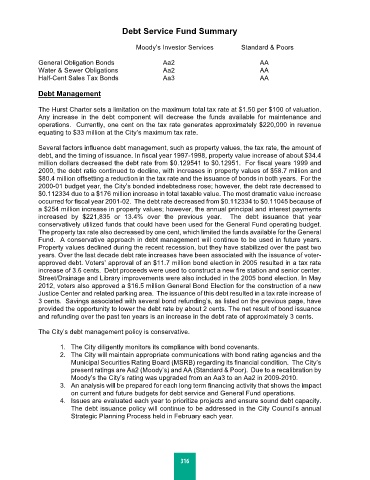

Debt Service Fund Summary

Moody’s Investor Services Standard & Poors

General Obligation Bonds Aa2 AA

Water & Sewer Obligations Aa2 AA

Half-Cent Sales Tax Bonds Aa3 AA

Debt Management

The Hurst Charter sets a limitation on the maximum total tax rate at $1.50 per $100 of valuation.

Any increase in the debt component will decrease the funds available for maintenance and

operations. Currently, one cent on the tax rate generates approximately $220,000 in revenue

equating to $33 million at the City’s maximum tax rate.

Several factors influence debt management, such as property values, the tax rate, the amount of

debt, and the timing of issuance. In fiscal year 1997-1998, property value increase of about $34.4

million dollars decreased the debt rate from $0.129541 to $0.12951. For fiscal years 1999 and

2000, the debt ratio continued to decline, with increases in property values of $58.7 million and

$80.4 million offsetting a reduction in the tax rate and the issuance of bonds in both years. For the

2000-01 budget year, the City’s bonded indebtedness rose; however, the debt rate decreased to

$0.112334 due to a $176 million increase in total taxable value. The most dramatic value increase

occurred for fiscal year 2001-02. The debt rate decreased from $0.112334 to $0.11045 because of

a $254 million increase in property values; however, the annual principal and interest payments

increased by $221,835 or 13.4% over the previous year. The debt issuance that year

conservatively utilized funds that could have been used for the General Fund operating budget.

The property tax rate also decreased by one cent, which limited the funds available for the General

Fund. A conservative approach in debt management will continue to be used in future years.

Property values declined during the recent recession, but they have stabilized over the past two

years. Over the last decade debt rate increases have been associated with the issuance of voter-

approved debt. Voters’ approval of an $11.7 million bond election in 2005 resulted in a tax rate

increase of 3.6 cents. Debt proceeds were used to construct a new fire station and senior center.

Street/Drainage and Library improvements were also included in the 2005 bond election. In May

2012, voters also approved a $16.5 million General Bond Election for the construction of a new

Justice Center and related parking area. The issuance of this debt resulted in a tax rate increase of

3 cents. Savings associated with several bond refunding’s, as listed on the previous page, have

provided the opportunity to lower the debt rate by about 2 cents. The net result of bond issuance

and refunding over the past ten years is an increase in the debt rate of approximately 3 cents.

The City’s debt management policy is conservative.

1. The City diligently monitors its compliance with bond covenants.

2. The City will maintain appropriate communications with bond rating agencies and the

Municipal Securities Rating Board (MSRB) regarding its financial condition. The City’s

present ratings are Aa2 (Moody’s) and AA (Standard & Poor). Due to a recalibration by

Moody’s the City’s rating was upgraded from an Aa3 to an Aa2 in 2009-2010.

3. An analysis will be prepared for each long term financing activity that shows the impact

on current and future budgets for debt service and General Fund operations.

4. Issues are evaluated each year to prioritize projects and ensure sound debt capacity.

The debt issuance policy will continue to be addressed in the City Council’s annual

Strategic Planning Process held in February each year.

316