Page 334 - Hurst FY20 Approved Budget

P. 334

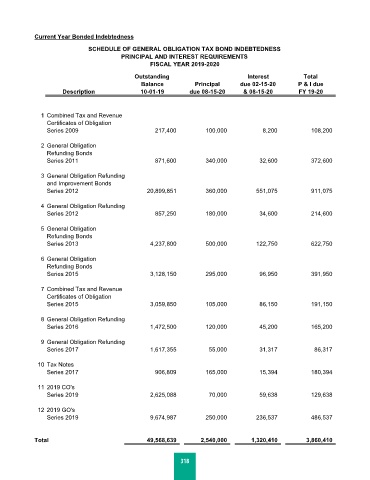

Current Year Bonded Indebtedness

SCHEDULE OF GENERAL OBLIGATION TAX BOND INDEBTEDNESS

PRINCIPAL AND INTEREST REQUIREMENTS

FISCAL YEAR 2019-2020

Outstanding Interest Total

Balance Principal due 02-15-20 P & I due

Description 10-01-19 due 08-15-20 & 08-15-20 FY 19-20

1 Combined Tax and Revenue

Certificates of Obligation

Series 2009 217,400 100,000 8,200 108,200

2 General Obligation

Refunding Bonds

Series 2011 871,600 340,000 32,600 372,600

3 General Obligation Refunding

and Improvement Bonds

Series 2012 20,899,851 360,000 551,075 911,075

4 General Obligation Refunding

Series 2012 857,250 180,000 34,600 214,600

5 General Obligation

Refunding Bonds

Series 2013 4,237,800 500,000 122,750 622,750

6 General Obligation

Refunding Bonds

Series 2015 3,128,150 295,000 96,950 391,950

7 Combined Tax and Revenue

Certificates of Obligation

Series 2015 3,059,850 105,000 86,150 191,150

8 General Obligation Refunding

Series 2016 1,472,500 120,000 45,200 165,200

9 General Obligation Refunding

Series 2017 1,617,355 55,000 31,317 86,317

10 Tax Notes

Series 2017 906,809 165,000 15,394 180,394

11 2019 CO's

Series 2019 2,625,088 70,000 59,638 129,638

12 2019 GO's

Series 2019 9,674,987 250,000 236,537 486,537

Total 49,568,639 2,540,000 1,320,410 3,860,410

318