Page 95 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 95

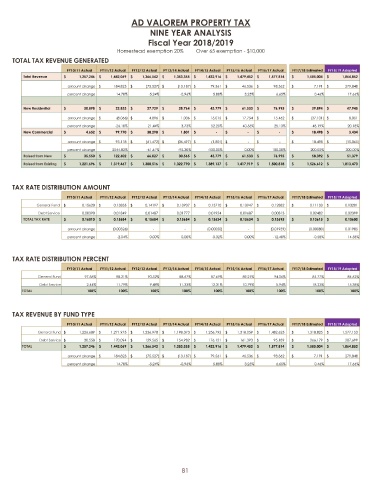

AD VALOREM PROPERTY TAX

NINE YEAR ANALYSIS

Fiscal Year 2018/ 2019

Homestead exemption 20% Over 65 exemption - $ 10,000

TOTAL TAX REVENUE GENERATED

FY10/11 Actual FY11/ 12 Actual FY12/13 Actual FY13/14 Actual FY14/15 Actual FY15/16 Actual FY16/17 Actual FY17/18 Estimated FY18/19 Adopted

Total Revenue 1,257,246$ 1,442,069$ 1,366,542$ 1,353,355$ 1,432,916$ 1,479,452$ 1,577,814$ 1,585,004$ 1,864,852$

amount change 184,823$ ( 75,527)$ ( 13,187)$ 79,561$ 46,536$ 98,362$ 7,191$ 279,848$

percent change 14.70%- 5.24%- 0.96% 5.88% 3.25% 6.65% 0.46% 17.66%

New Residential 30,898$ 22,833$ 27,729$ 28,764$ 43,779$ 61,533$ 76,995$ 39,894$ 47,945$

amount change ( 8,066)$ 4,896$ 1,036$ 15,015$ 17,754$ 15,462$ ( 37,101)$ 8,051$

percent change - 26.10% 21.44% 3.73% 52.20% 40.55% 25.13%- 48.19% 20.18%

New Commercial 4,652$ 99,770$ 38,298$ 1,801$ -$ -$ -$ 18,498$ 3,434$

amount change 95,118$ ( 61,472)$ ( 36,497)$ ( 1,801)$ -$ -$ 18,498$ ( 15,065)$

percent change 2044.82%- 61.61%- 95.30%- 100.00% 0.00% 100.00% 200.00% 300.00%

Raised from New 35, 550$ 122, 602$ 66, 027$ 30, 565$ 43, 779$ 61, 533$ 76, 995$ 58, 392$ 51, 379$

Raised from Existing 1,221,696$ 1,319,467$ 1,300,516$ 1,322,790$ 1,389,137$ 1,417,919$ 1,500,818$ 1,526,612$ 1,813,473$

TAX RATE DISTRIBUTION AMOUNT

FY10/11 Actual FY11/ 12 Actual FY12/13 Actual FY13/14 Actual FY14/15 Actual FY15/16 Actual FY16/17 Actual FY17/18 Estimated FY18/19 Adopted

General Fund 0.15620$ 0.13835$ 0.14197$ 0.13907$ 0.13710$ 0.13947$ 0.12882$ 0.11133$ 0.13201$

Debt Service 0.00390 0.01849 0.01487 0.01777 0.01924 0.01687 0.00813 0.02482 0.02399

TOTAL TAX RATE 0.16010$ 0.15684$ 0.15684$ 0.15684$ 0.15634$ 0.15634$ 0.13695$ 0.13615$ 0.15600$

amount change ( 0.00326) - - ( 0.00050) - ( 0.01939) ( 0.00080) 0.01985

percent change - 2.04% 0.00% 0.00%- 0.32% 0.00%- 12.40%- 0.58% 14.58%

TAX RATE DISTRIBUTION PERCENT

FY10/11 Actual FY11/ 12 Actual FY12/13 Actual FY13/14 Actual FY14/15 Actual FY15/16 Actual FY16/17 Actual FY17/18 Estimated FY18/19 Adopted

General Fund 97.56% 88.21% 90.52% 88.67% 87.69% 89.21% 94.06% 81.77% 84.62%

Debt Service 2.44% 11.79% 9.48% 11.33% 12.31% 10.79% 5.94% 18.23% 15.38%

TOTAL 100% 100% 100% 100% 100% 100% 100% 100% 100%

TAX REVENUE BY FUND TYPE

FY10/11 Actual FY11/ 12 Actual FY12/13 Actual FY13/14 Actual FY14/15 Actual FY15/16 Actual FY16/17 Actual FY17/18 Estimated FY18/19 Adopted

General Fund 1,226,689$ 1,271,975$ 1,236,978$ 1,198,373$ 1,256,795$ 1,318,059$ 1,482,625$ 1,318,825$ 1,577,153$

Debt Service 30,558$ 170,094$ 129,565$ 154,982$ 176,121$ 161,393$ 95,189$ 266,179$ 287,699$

TOTAL 1,257,246$ 1,442,069$ 1,366,542$ 1,353,355$ 1,432,916$ 1,479,452$ 1,577,814$ 1,585,004$ 1,864,852$

amount change 184,823$ ( 75,527)$ ( 13,187)$ 79,561$ 46,536$ 98,362$ 7,191$ 279,848$

percent change 14.70%- 5.24%- 0.96% 5.88% 3.25% 6.65% 0.46% 17.66%

81