Page 94 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 94

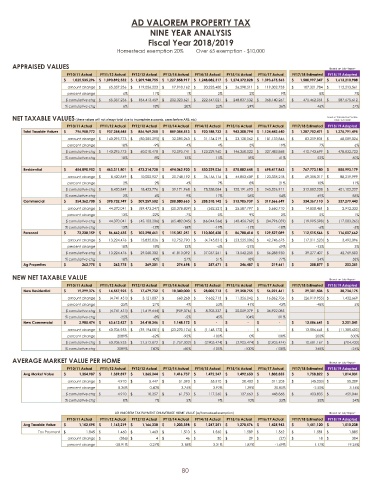

AD VALOREM PROPERTY TAX

NINE YEAR ANALYSIS

Fiscal Year 2018/ 2019

Homestead exemption 20% Over 65 exemption - $ 10,000

APPRAISED VALUES Based on July Report

FY10/ 11 Actual FY11/ 12 Actual FY12/ 13 Actual FY13/ 14 Actual FY14/ 15 Actual FY15/ 16 Actual FY16/ 17 Actual FY17/ 18 Estimated FY18/ 19 Adopted

1,025,535,296$ 1,090,892,532$ 1,209,948,755$ 1,227,858,917$ 1,248,082,317$ 1,274,372,828$ 1,393,675,563$ 1,500,997,347$ 1,613,210,908$

amount change 65,357,236$ 119,056,223$ 17,910,162$ 20,223,400$ 26,290,511$ 119,302,735$ 107,321,784$ 112,213,561$

percent change 6% 11% 1% 2% 2% 9% 8% 7%

cumulative chg 65,357,236$ 184,413,459$ 202,323,621$ 222,547,021$ 248,837,532$ 368,140,267$ 475,462,051$ 587,675,612$

cumulative chg 6% 18% 20% 22% 24% 36% 46% 57%

Based on "Estimated Net Taxable

NET TAXABLE VALUES (these values will not always total due to incomplete accounts, cases before ARB, etc) Value " July report

FY10/11 Actual FY11/ 12 Actual FY12/13 Actual FY13/14 Actual FY14/15 Actual FY15/16 Actual FY16/17 Actual FY17/18 Estimated FY18/19 Adopted

Total Taxable Values 796,958,772$ 937,254,545$ 856,969,250$ 889,054,513$ 920,188,732$ 943,308,794$ 1,124,442,640$ 1,207,702,471$ 1,275,791,495$

amount change 140,295,773$ ( 80,285,295)$ 32,085,263$ 31,134,219$ 23,120,062$ 181,133,846$ 83,259,831$ 68,089,024$

percent change 18%- 9% 4% 4% 3% 19% 7% 6%

cumulative chg 140,295,773$ 60,010,478$ 92,095,741$ 123,229,960$ 146,350,022$ 327,483,868$ 410,743,699$ 478,832,723$

cumulative chg 18% 8% 12% 15% 18% 41% 52% 60%

Residential 454,890,952$ 463,311,801$ 473,314,728$ 494,062,920$ 530,229,036$ 575,082,645$ 698,417,863$ 767,773,180$ 855,993,179$

amount change 8,420,849$ 10,002,927$ 20,748,192$ 36,166,116$ 44,853,609$ 123,335,218$ 69,355,317$ 88,219,999$

percent change 2% 2% 4% 7% 8% 21% 10% 11%

cumulative chg 8,420,849$ 18,423,776$ 39,171,968$ 75,338,084$ 120,191,693$ 243,526,911$ 312,882,228$ 401,102,227$

cumulative chg 2% 4% 9% 17% 26% 54% 69% 88%

Commercial 354,362,708$ 398,732,749$ 309,259,502$ 288,880,663$ 288,318,142$ 313,905,939$ 319,566,649$ 334,367,110$ 337,279,443$

amount change 44,370,041$ ( 89,473,247)$ ( 20,378,839)$ ( 562,521)$ 25,587,797$ 5,660,710$ 14,800,461$ 2,912,333$

percent change 13%- 22%- 7% 0% 9% 2% 5% 1%

cumulative chg 44,370,041$ ( 45,103,206)$ ( 65,482,045)$ ( 66,044,566)$ ( 40,456,769)$ ( 34,796,059)$ ( 19,995,598)$ ( 17,083,265)$

cumulative chg 13%- 13%- 18%- 19%- 11%- 10%- 6%- 5%

Personal 73,238,159$ 86,462,635$ 102,298,461$ 115,051,251$ 110,305,420$ 86,780,414$ 129,527,089$ 112,515,566$ 116,007,662$

amount change 13,224,476$ 15,835,826$ 12,752,790$ ( 4,745,831)$ (23,525,006)$ 42,746,675$ ( 17,011,523)$ 3,492,096$

percent change 18% 18% 12%- 4%- 21% 49%- 13% 3%

cumulative chg 13,224,476$ 29,060,302$ 41,813,092$ 37,067,261$ 13,542,255$ 56,288,930$ 39,277,407$ 42,769,503$

cumulative chg 18% 40% 57% 51% 18% 77% 54% 58%

Ag Properties 263,775$ 263,775$ 269,301$ 274,698$ 257,671$ 246,487$ 219,661$ 208,877$ 203,351$

NEW NET TAXABLE VALUE Based on July Report

FY10/11 Actual FY11/ 12 Actual FY12/13 Actual FY13/14 Actual FY14/15 Actual FY15/16 Actual FY16/17 Actual FY17/18 Estimated FY18/19 Adopted

New Residential 19,299,376$ 14,557,925$ 17,679,732$ 18,340,000$ 28,002,713$ 39,358,755$ 56,221,461$ 29,301,506$ 30,734,175$

amount change ( 4,741,451)$ 3,121,807$ 660,268$ 9,662,713$ 11,356,042$ 16,862,706$ ( 26,919,955)$ 1,432,669$

percent change - 25% 21% 4% 53% 41% 43%- 48% 5%

cumulative chg ( 4,741,451)$ ( 1,619,644)$ ( 959,376)$ 8,703,337$ 20,059,379$ 36,922,085$

cumulative chg - 25%- 8%- 5% 45% 104% 191%

New Commercial 2,905,474$ 63,612,427$ 24,418,346$ 1,148,172$ -$ -$ -$ 13,586,641$ 2,201,041$

amount change 60,706,953$ ( 39,194,081)$ ( 23,270,174)$ ( 1,148,172)$ -$ -$ 13,586,641$ ( 11,385,600)$

percent change 2089%- 62%- 95%- 100% 0% 100% 200% 300%

cumulative chg 60,706,953$ 21,512,872$ ( 1,757,302)$ ( 2,905,474)$ ( 2,905,474)$ ( 2,905,474)$ 10,681,167$ ( 704,433)$

cumulative chg 2089% 740%- 60%- 100%- 100%- 100% 368%- 24%

AVERAGE MARKET VALUE PER HOME Based on July Report

FY10/11 Actual FY11/ 12 Actual FY12/13 Actual FY13/14 Actual FY14/15 Actual FY15/16 Actual FY16/17 Actual FY17/18 Estimated FY18/19 Adopted

Avg Market Value 1,354,987$ 1,359,897$ 1,365,344$ 1,416,737$ 1,472,247$ 1,492,650$ 1,803,855$ 1,758,822$ 1,814,031$

amount change 4,910$ 5,447$ 51,393$ 55,510$ 20,403$ 311,205$ ( 45,033)$ 55,209$

percent change 0.36% 0.40% 3.76% 3.92% 1.39% 20.85%- 2.50% 3.14%

cumulative chg 4,910$ 10,357$ 61,750$ 117,260$ 137,663$ 448,868$ 403,835$ 459,044$

cumulative chg 0% 1% 5% 9% 10% 33% 30% 34%

AD VALOREM TAX PAYMENT ON AVERAGE HOME VALUE ( w/ homestead exemption) Based on July Report

FY10/ 11 Actual FY11/ 12 Actual FY12/ 13 Actual FY13/ 14 Actual FY14/ 15 Actual FY15/ 16 Actual FY16/ 17 Actual FY17/ 18 Estimated FY18/ 19 Adopted

Avg Taxable Value 1,152,595$ 1,163,219$ 1,166,338$ 1,203,398$ 1,247,251$ 1,270,576$ 1,425,943$ 1,451,120$ 1,510,238$

Tax Payment 1,845$ 1,460$ 1,463$ 1,510$ 1,560$ 1,589$ 1,562$ 1,581$ 1,885$

amount change ( 386)$ 4$ 46$ 50$ 29$ (27)$ 18$ 304$

percent change - 20.91% 0.27% 3.18% 3.31% 1.87%- 1.69% 1.17% 19.25%

80