Page 92 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 92

Section 2 Financial Analysis

Property Tax Overview

42750 0.37512 0.0.28927 0.15600 Southlake Trophy Club Keller Roanoke Haslet Grapevine Westlake This

33304

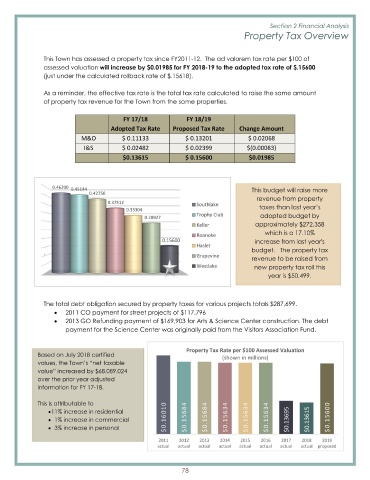

Town has assessed a property tax since FY2011- 12. The ad valorem tax rate per $100 of assessed

valuation will increase by $0.01985 for FY

2018- 19 to the adopted tax rate of $.15600 just under the calculated rollback rate of $.15618). As

a reminder, the effective tax rate is the total tax rate

calculated to raise of property tax

the same amount revenue for the Town from

the same properties. FY 17/18 Adopted Tax

Rate FY 18/19 Proposed Tax Rate Change

Amount M& O $ 0. 11133 $ 0.

actual 2017 actual 2018

actual 2019 18. This is attributable to

11% in

increase

proposed Property

shown

in

increase

Tax Rate residential 1% commercial

in millions)

increase

in

per $100 3%

0. personal This budget

will raise more revenue from

46200

Assessed Valuation property taxes than last year’

0.

s adopted budget by

45144

approximately $272, 358 which is

0. a 17.10% increase from

last year' s budget.

13201 $ 0.02068 I&02482 $ 0.02399 $(0.00083) 0.13615 $ 0.

0.

S $

15600 $0.01985 The total debt obligation secured by

property taxes for various projects totals $287,699. 2011 CO payment for street projects

796

of $2013 GO Refunding payment of $169,903 for Arts &

Science

117,

actual 2012 actual 2013 actual 2014 actual

Center construction. The debt payment

2015 actual 2016

for the Science Center was originally

paid from the Visitors Association Fund.

Based on July 2018 certified

values, the Town’ s “net

taxable value” increased by $

68, 089,024 over

the prior year adjusted

information for FY 17-

0. 0. 0. 0. 0. 0. 0. 0. 0.

16010$ 15684$ 15684$ 15634$ 15634$ 15634$ 13695$ 13615$ 156002011

The