Page 93 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 93

Section 2 Financial Analysis

Property Tax Overview

Homestead Exemptions

The Westlake Town Council approved a homestead exemption of 20%, which is the maximum

amount allowed by the State of Texas.

Tax Freeze

The Town Council also approved a tax freeze for all residential accounts identified as over 65 by

the tax appraisal district. To learn more information about the tax freeze or find out if you qualify,

http://www.tad.org/

http://www.dentoncad.org/

please visit the following websites: Denton Central Appraisal District or Tarrant Appraisal District.

Jurisdictions - The Town of Westlake contracts with the Tarrant County Tax Assessor Collector’ s

Office to collect the Town’ s portion of local property tax. There are multiple taxing jurisdictions

within Westlake’ s boundaries; whether or not a business or residence is required to pay tax to a

particular jurisdiction is determined by where they are located within Westlake and the

boundaries of the respective taxing jurisdictions.

Currently, the following taxing jurisdictions collect property taxes in Westlake:

Independent School Districts; Carroll, Keller and Northwest

Tarrant County; College and Hospital

Denton County and Trophy Club MUD 1

Westlake residents can determine which taxing jurisdictions apply to their property as well as

obtain current property tax rate information by conducting a property search on the

http://www.dentoncad.org/

http://www.tad.org/

appropriate appraisal district website: Denton Central Appraisal District or Tarrant Appraisal

http://

District.

www.t

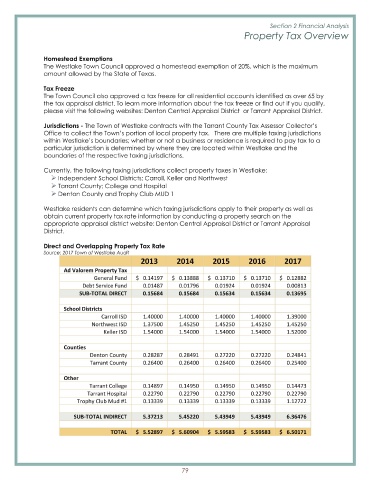

Direct and Overlapping Property Tax Rate

ad.org

Source: 2017 Town of Westlake Audit

/

2013 2014 2015 2016 2017

Ad Valorem Property Tax

General Fund $ 0.14197 $ 0.13888 $ 0.13710 $ 0.13710 $ 0.12882

Debt Service Fund 0.01487 0.01796 0.01924 0.01924 0.00813

SUB- TOTAL DIRECT 0.15684 0.15684 0.15634 0.15634 0.13695

School Districts

Carroll ISD 1.40000 1.40000 1.40000 1.40000 1.39000

Northwest ISD 1.37500 1.45250 1.45250 1.45250 1.45250

Keller ISD 1.54000 1.54000 1.54000 1.54000 1.52000

Counties

Denton County 0.28287 0.28491 0.27220 0.27220 0.24841

Tarrant County 0.26400 0.26400 0.26400 0.26400 0.25400

Other

Tarrant College 0.14897 0.14950 0.14950 0.14950 0.14473

Tarrant Hospital 0.22790 0.22790 0.22790 0.22790 0.22790

Trophy Club Mud #1 0.13339 0.13339 0.13339 0.13339 1.12722

SUB- TOTAL INDIRECT 5.37213 5.45220 5.43949 5.43949 6.36476

TOTAL $ 5.52897 $ 5.60904 $ 5.59583 $ 5.59583 $ 6.50171

79