Page 122 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 122

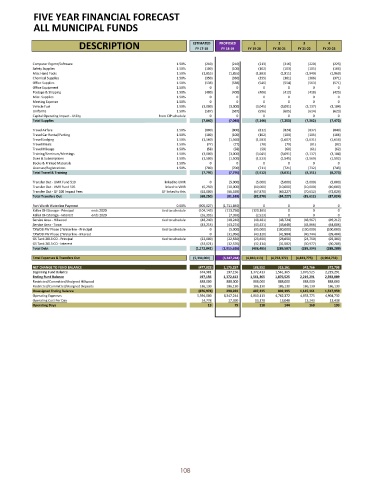

FIVE YEAR FINANCIAL FORECAST

ALL MUNICIPAL FUNDS

ESTIMATED PROPOSED 1 2 3 4

DESCRIPTION FY 17- 18 FY 18- 19 FY 19- 20 FY 20- 21 FY 21- 22 FY 22- 23

Computer Eqpmt/ Software 1.50%( 210)( 210)( 213)( 216)( 220)( 223)

Safety Supplies 1.50%( 100)( 100)( 102)( 103)( 105)( 106)

Misc Hand Tools 1.50%( 1,855)( 1,855)( 1,883)( 1,911)( 1,940)( 1,969)

Chemical Supplies 1.50%( 350)( 350)( 355)( 361)( 366)( 371)

Office Supplies 1.50%( 538)( 538)( 546)( 554)( 563)( 571)

Office Equipment 1.50% 0 0 0 0 0 0

Postage & Shipping 1.50%( 400)( 400)( 406)( 412)( 418)( 425)

Misc. Supplies 1.50% 0 0 0 0 0 0

Meeting Expense 1.50% 0 0 0 0 0 0

Vehicle Fuel 1.50%( 3,000)( 3,000)( 3,045)( 3,091)( 3,137)( 3,184)

Uniforms 1.50%( 587)( 587)( 596)( 605)( 614)( 623)

Capital Operating Impact - Utility from CIP schedule 0 0 0 0 0 0

Total Supplies ( 7,040)( 7,040)( 7,146)( 7,253)( 7,362)( 7,472)

Travel Airfare 1.50%( 800)( 800)( 812)( 824)( 837)( 849)

Travel Car Rental/ Parking 1.50%( 100)( 100)( 102)( 103)( 105)( 106)

Travel Lodging 1.50%( 1,560)( 1,560)( 1,583)( 1,607)( 1,631)( 1,656)

Travel Meals 1.50%( 77)( 77)( 78)( 79)( 81)( 82)

Travel Mileage 1.50%( 58)( 58)( 59)( 60)( 61)( 62)

Training/ Seminars/ Meetings 1.50%( 3,000)( 3,000)( 3,045)( 3,091)( 3,137)( 3,184)

Dues & Subscriptions 1.50%( 1,500)( 1,500)( 1,523)( 1,545)( 1,569)( 1,592)

Books & Printed Materials 1.50% 0 0 0 0 0 0

Licenses/ Registrations 1.50%( 700)( 700)( 711)( 721)( 732)( 743)

Total Travel & Training ( 7,795)( 7,795)( 7,912)( 8,031)( 8,151)( 8,273)

Transfer Out - UMR Fund 510 linked to UMR 0 ( 5,000)( 5,000)( 5,000)( 5,000)( 5,000)

Transfer Out - VMR Fund 505 linked to VMR ( 6,250)( 10, 000)( 10, 000)( 10, 000)( 10, 000)( 10, 000)

Transfer Out - GF 100 Impact Fees GF linked to this ( 62, 000)( 66, 539)( 67, 870)( 69, 227)( 70, 612)( 72, 024)

Total Transfers Out ( 68, 250)( 81, 539)( 82, 870)( 84, 227)( 85, 612)( 87, 024)

Fort Worth Waterline Payment 0.00%( 905, 027)( 1,711, 840) 0 0 0 0

Keller OH Storage - Principal ends 2020 tied to schedule ( 104, 143)( 113, 756)( 120, 165) 0 0 0

Keller OH Storage - Interest ends 2020 ( 16, 395)( 7,393)( 2,523) 0 0 0

Service Area - Hillwood tied to schedule ( 48, 240)( 48, 240)( 48, 481)( 48, 724)( 48, 967)( 49, 212)

Service Area - Town ( 43, 215)( 43, 215)( 43, 431)( 43, 648)( 43, 866)( 44, 086)

TXWDB FW Phase 2 Waterline - Principal tied to schedule 0 ( 5,000)( 95,000)( 100, 000)( 100, 000)( 100, 000)

TXWDB FW Phase 2 Waterline - Interest 0 ( 31, 056)( 43, 120)( 41, 984)( 40, 744)( 39, 404)

GS Tank 2013 CO - Principal tied to schedule ( 22,000)( 22,550)( 23,650)( 23,650)( 24,750)( 25,300)

GS Tank 2013 CO - Interest ( 33, 021)( 32, 576)( 32, 114)( 31, 582)( 30, 977)( 30, 288)

Total Debt ( 1,172, 041)( 2,015, 626)( 408, 485)( 289, 587)( 289, 304)( 288, 289)

Total Expenses & Transfers Out ( 5,394, 000)( 6, 347, 244)( 4,810, 113)( 4,762, 372)( 4,833, 775)( 4,904, 732)

NET CHANGE TO FUND BALANCE ( 477, 825) 1,175, 257 188, 952 315, 161 342, 766 372, 798

Beginning Fund Balance 674, 981 197, 156 1,372, 413 1,561, 365 1,876, 525 2,219, 291

Ending Fund Balance 197, 156 1,372, 413 1,561, 365 1,876, 525 2,219, 291 2,592, 089

Restricted/ Committed/ Assigned Hillwood 888, 000 888, 000 888, 000 888, 000 888, 000 888, 000

Restricted/ Committed/ Assigned Deposits 186, 130 186, 130 186, 130 186, 130 186, 130 186, 130

Unassigned Ending Balance ( 876, 974) 298, 283 487, 235 802, 395 1,145, 161 1,517, 959

Operating Expenses 5,394, 000 6,347, 244 4,810, 113 4,762, 372 4,833, 775 4,904, 732

Operating Cost Per Day 14, 778 17, 390 13, 178 13, 048 13, 243 13, 438

Operating Days 13 79 118 144 168 193

108