Page 126 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 126

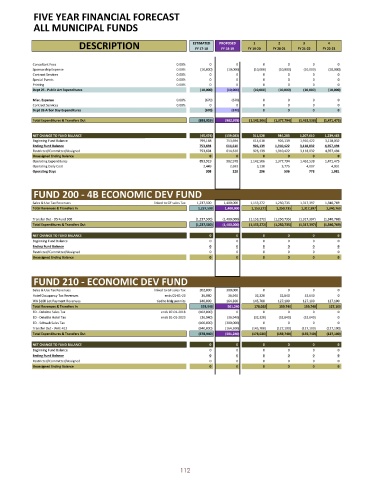

FIVE YEAR FINANCIAL FORECAST

ALL MUNICIPAL FUNDS

ESTIMATED PROPOSED 1 2 3 4

DESCRIPTION FY 17- 18 FY 18- 19 FY 19- 20 FY 20- 21 FY 21- 22 FY 22- 23

Consultant Fees 0.00% 0 0 0 0 0 0

Sponsorship Expense 0.00%( 10, 000)( 10, 000)( 10, 000)( 10, 000)( 10, 000)( 10, 000)

Contract Services 0.00% 0 0 0 0 0 0

Special Events 0.00% 0 0 0 0 0 0

Printing 0.00% 0 0 0 0 0 0

Dept 25 - Public Art Expenditures ( 10, 000)( 10, 000)( 10, 000)( 10, 000)( 10, 000)( 10, 000)

Misc. Expense 0.00%( 670)( 670) 0 0 0 0

Contract Services 0.00% 0 0 0 0 0 0

Dept 26 Arbor Day Expenditures ( 670)( 670) 0 0 0 0

Total Expenditures & Transfers Out ( 893, 919)( 982, 978)( 1,142, 506)( 1,377, 794)( 1,462, 538)( 1,471, 475)

NET CHANGE TO FUND BALANCE ( 45, 474)( 139, 083) 311, 528 984, 283 1,207, 610 1,239, 463

Beginning Fund Balance 799, 168 753, 694 614, 610 926, 139 1,910, 422 3,118, 032

Ending Fund Balance 753, 694 614, 610 926, 139 1,910, 422 3,118, 032 4,357, 494

Restricted/ Committed/ Assigned 753, 694 614, 610 926, 139 1,910, 422 3,118, 032 4,357, 494

Unassigned Ending Balance 0 0 0 0 0 0

Operating Expenditures 893, 919 982, 978 1,142, 506 1,377, 794 1,462, 538 1,471, 475

Operating Daily Cost 2,449 2,693 3,130 3,775 4,007 4,031

Operating Days 308 228 296 506 778 1,081

FUND 200 - 4B ECONOMIC DEV FUND

Sales & Use Tax Revenues linked to GF sales Tax 1,237, 500 1,400, 000 1,153, 272 1,250, 735 1,317, 397 1,340, 769

Total Revenues & Transfers In 1, 237, 500 1, 400, 000 1,153, 272 1,250, 735 1,317, 397 1,340, 769

Transfer Out - DS Fund 300 ( 1,237, 500)( 1,400, 000)( 1,153, 272)( 1,250, 735)( 1,317, 397)( 1,340, 769)

Total Expenditures & Transfers Out ( 1, 237, 500)( 1, 400, 000)( 1,153, 272)( 1,250, 735)( 1,317, 397)( 1,340, 769)

NET CHANGE TO FUND BALANCE 0 0 0 0 0 0

Beginning Fund Balance 0 0 0 0 0 0

Ending Fund Balance 0 0 0 0 0 0

Restricted/ Committed/ Assigned 0 0 0 0 0 0

Unassigned Ending Balance 0 0 0 0 0 0

FUND 210 - ECONOMIC DEV FUND

Sales & Use Tax Revenues linked to GF sales Tax 202, 000 300, 000 0 0 0 0

Hotel Occupancy Tax Revenues ends 01- 01-23 36,940 36,940 32,320 32,640 32,640 0

WA $ 10K Lot Payment Revenues tied to bldg permits 340, 000 164, 300 145, 700 127, 100 127, 100 127, 100

Total Revenues & Transfers In 578, 940 501, 240 178, 020 159, 740 159, 740 127, 100

ED - Deloitte Sales Tax ends 07- 01- 2018 ( 102, 000) 0 0 0 0 0

ED - Deloitte Hotel Tax ends 01- 01-2023 ( 36,940)( 36,940)( 32,320)( 32,640)( 32,640) 0

ED - Schwab Sales Tax ( 100, 000)( 300, 000) 0 0 0 0

Transfer Out - WAE 412 ( 340, 000)( 164, 300)( 145, 700)( 127, 100)( 127, 100)( 127, 100)

Total Expenditures & Transfers Out ( 578, 940)( 501, 240)( 178, 020)( 159, 740)( 159, 740)( 127, 100)

NET CHANGE TO FUND BALANCE 0 0 0 0 0 0

Beginning Fund Balance 0 0 0 0 0 0

Ending Fund Balance 0 0 0 0 0 0

Restricted/ Committed/ Assigned 0 0 0 0 0 0

Unassigned Ending Balance 0 0 0 0 0 0

112